Page 77 - Annual Report 2022

P. 77

15 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

3. Significant accounting policies (continued)

(g) Financial assets and liabilities (continued)

(v) Reclassifications of financial assets (continued)

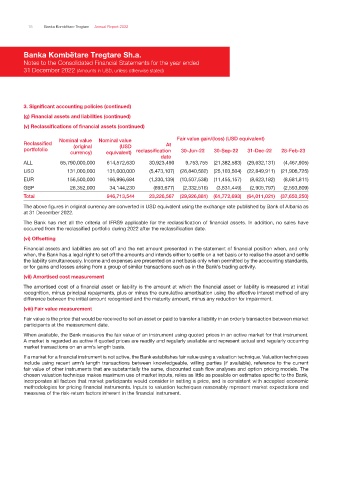

Nominal value Nominal value Fair value gain/(loss) (USD equivalent)

Reclassified At

portfofolio (original (USD reclassification 30-Jun-22 30-Sep-22 31-Dec-22 28-Feb-23

currency) equivalent)

date

ALL 65,790,000,000 614,572,630 30,923,490 9,753,755 (21,382,583) (29,632,131) (4,467,905)

USD 131,000,000 131,000,000 (5,473,107) (26,840,582) (25,103,504) (22,849,911) (21,906,725)

EUR 156,500,000 166,996,684 (1,330,139) (10,507,538) (11,455,157) (8,623,182) (8,681,811)

GBP 28,352,000 34,144,230 (893,677) (2,332,516) (3,831,449) (2,905,797) (2,593,809)

Total 946,713,544 23,226,567 (29,926,881) (61,772,693) (64,011,021) (37,650,250)

The above figures in original currency are converted in USD equivalent using the exchange rate published by Bank of Albania as

at 31 December 2022.

The Bank has met all the criteria of IFRS9 applicable for the reclassification of financial assets. In addition, no sales have

occurred from the reclassified portfolio during 2022 after the reclassification date.

(vi) Offsetting

Financial assets and liabilities are set off and the net amount presented in the statement of financial position when, and only

when, the Bank has a legal right to set off the amounts and intends either to settle on a net basis or to realise the asset and settle

the liability simultaneously. Income and expenses are presented on a net basis only when permitted by the accounting standards,

or for gains and losses arising from a group of similar transactions such as in the Bank’s trading activity.

(vii) Amortised cost measurement

The amortised cost of a financial asset or liability is the amount at which the financial asset or liability is measured at initial

recognition, minus principal repayments, plus or minus the cumulative amortisation using the effective interest method of any

difference between the initial amount recognised and the maturity amount, minus any reduction for impairment.

(viii) Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market

participants at the measurement date.

When available, the Bank measures the fair value of an instrument using quoted prices in an active market for that instrument.

A market is regarded as active if quoted prices are readily and regularly available and represent actual and regularly occurring

market transactions on an arm’s length basis.

If a market for a financial instrument is not active, the Bank establishes fair value using a valuation technique. Valuation techniques

include using recent arm’s length transactions between knowledgeable, willing parties (if available), reference to the current

fair value of other instruments that are substantially the same, discounted cash flow analyses and option pricing models. The

chosen valuation technique makes maximum use of market inputs, relies as little as possible on estimates specific to the Bank,

incorporates all factors that market participants would consider in setting a price, and is consistent with accepted economic

methodologies for pricing financial instruments. Inputs to valuation techniques reasonably represent market expectations and

measures of the risk-return factors inherent in the financial instrument.