Page 80 - Annual Report 2022

P. 80

Banka Kombëtare Tregtare Annual Report 2022 18

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

3. Significant accounting policies (continued)

(xi) Derivative financial instruments and hedge accounting (continued)

- Futures (continued)

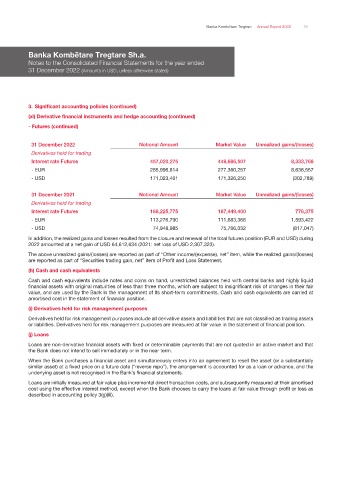

31 December 2022 Notional Amount Market Value Unrealized gains/(losses)

Derivatives held for trading

Interest rate Futures 457,020,275 448,686,507 8,333,768

- EUR 285,996,814 277,360,257 8,636,557

- USD 171,023,461 171,326,250 (302,789)

31 December 2021 Notional Amount Market Value Unrealized gains/(losses)

Derivatives held for trading

Interest rate Futures 188,225,775 187,449,400 776,375

- EUR 113,276,790 111,683,368 1,593,422

- USD 74,948,985 75,766,032 (817,047)

In addition, the realized gains and losses resulted from the closure and renewal of the total futures position (EUR and USD) during

2022 amounted at a net gain of USD 64,612,634 (2021: net loss of USD 2,307,323).

The above unrealized gains/(losses) are reported as part of “Other income/(expense), net” item, while the realized gains/(losses)

are reported as part of “Securities trading gain, net” item of Profit and Loss Statement.

(h) Cash and cash equivalents

Cash and cash equivalents include notes and coins on hand, unrestricted balances held with central banks and highly liquid

financial assets with original maturities of less than three months, which are subject to insignificant risk of changes in their fair

value, and are used by the Bank in the management of its short-term commitments. Cash and cash equivalents are carried at

amortised cost in the statement of financial position.

(i) Derivatives held for risk management purposes

Derivatives held for risk management purposes include all derivative assets and liabilities that are not classified as trading assets

or liabilities. Derivatives held for risk management purposes are measured at fair value in the statement of financial position.

(j) Loans

Loans are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market and that

the Bank does not intend to sell immediately or in the near term.

When the Bank purchases a financial asset and simultaneously enters into an agreement to resell the asset (or a substantially

similar asset) at a fixed price on a future date (“reverse repo”), the arrangement is accounted for as a loan or advance, and the

underlying asset is not recognised in the Bank’s financial statements.

Loans are initially measured at fair value plus incremental direct transaction costs, and subsequently measured at their amortised

cost using the effective interest method, except when the Bank chooses to carry the loans at fair value through profit or loss as

described in accounting policy 3(g)(iii).