Page 89 - Annual Report 2022

P. 89

27 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

4. Use of estimates and judgements (continued)

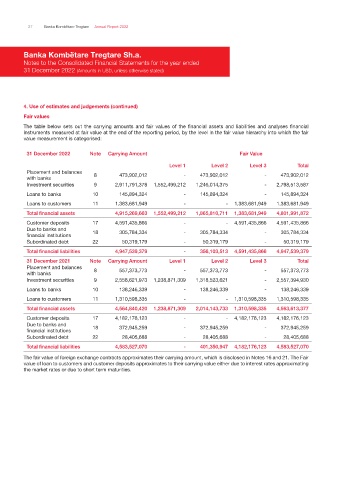

Fair values

The table below sets out the carrying amounts and fair values of the financial assets and liabilities and analyses financial

instruments measured at fair value at the end of the reporting period, by the level in the fair value hierarchy into which the fair

value measurement is categorised:

31 December 2022 Note Carrying Amount Fair Value

Level 1 Level 2 Level 3 Total

Placement and balances

with banks 8 473,902,012 - 473,902,012 - 473,902,012

Investment securities 9 2,911,791,378 1,552,499,212 1,246,014,375 - 2,798,513,587

Loans to banks 10 145,894,324 - 145,894,324 - 145,894,324

Loans to customers 11 1,383,681,949 - - 1,383,681,949 1,383,681,949

Total financial assets 4,915,269,663 1,552,499,212 1,865,810,711 1,383,681,949 4,801,991,872

Customer deposits 17 4,591,435,866 - - 4,591,435,866 4,591,435,866

Due to banks and 18 305,784,334 - 305,784,334 - 305,784,334

financial institutions

Subordinated debt 22 50,319,179 - 50,319,179 - 50,319,179

Total financial liabilities 4,947,539,379 - 356,103,513 4,591,435,866 4,947,539,379

31 December 2021 Note Carrying Amount Level 1 Level 2 Level 3 Total

Placement and balances 8 557,373,773 - 557,373,773 - 557,373,773

with banks

Investment securities 9 2,558,621,973 1,238,871,309 1,318,523,621 - 2,557,394,930

Loans to banks 10 138,246,339 - 138,246,339 - 138,246,339

Loans to customers 11 1,310,598,335 - - 1,310,598,335 1,310,598,335

Total financial assets 4,564,840,420 1,238,871,309 2,014,143,733 1,310,598,335 4,563,613,377

Customer deposits 17 4,182,176,123 - - 4,182,176,123 4,182,176,123

Due to banks and

financial institutions 18 372,945,259 - 372,945,259 - 372,945,259

Subordinated debt 22 28,405,688 - 28,405,688 - 28,405,688

Total financial liabilities 4,583,527,070 - 401,350,947 4,182,176,123 4,583,527,070

The fair value of foreign exchange contracts approximates their carrying amount, which is disclosed in Notes 16 and 21. The Fair

value of loan to customers and customer deposits approximates to their carrying value either due to interest rates approximating

the market rates or due to short term maturities.