Page 92 - Annual Report 2022

P. 92

Banka Kombëtare Tregtare Annual Report 2022 30

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

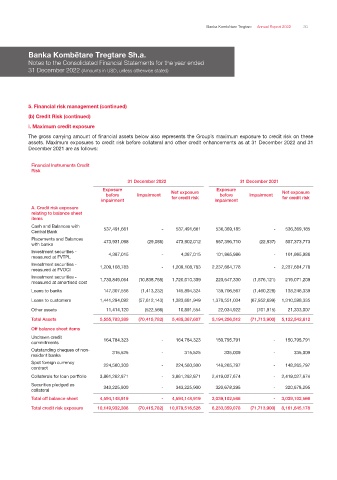

i. Maximum credit exposure

The gross carrying amount of financial assets below also represents the Group’s maximum exposure to credit risk on these

assets. Maximum exposures to credit risk before collateral and other credit enhancements as at 31 December 2022 and 31

December 2021 are as follows:

Financial Instruments Credit

Risk

31 December 2022 31 December 2021

Exposure Net exposure Exposure Net exposure

before Impairment before Impairment

impairment for credit risk impairment for credit risk

A. Credit risk exposure

relating to balance sheet

items

Cash and Balances with 537,491,661 - 537,491,661 536,369,185 - 536,369,185

Central Bank

Placements and Balances 473,931,098 (29,086) 473,902,012 557,396,710 (22,937) 557,373,773

with banks

Investment securities - 4,387,015 - 4,387,015 101,865,986 - 101,865,986

measured at FVTPL

Investment securities - 1,209,108,783 - 1,209,108,783 2,237,684,778 - 2,237,684,778

measured at FVOCI

Investment securities - 1,730,849,064 (10,838,755) 1,720,010,309 220,647,330 (1,576,121) 219,071,209

measured at amortised cost

Loans to banks 147,307,556 (1,413,232) 145,894,324 139,706,567 (1,460,228) 138,246,339

Loans to customers 1,441,294,092 (57,612,143) 1,383,681,949 1,378,551,034 (67,952,699) 1,310,598,335

Other assets 11,414,120 (522,566) 10,891,554 22,034,922 (701,915) 21,333,007

Total Assets 5,555,783,389 (70,415,782) 5,485,367,607 5,194,256,512 (71,713,900) 5,122,542,612

Off balance sheet items

Undrawn credit 164,784,323 - 164,784,323 150,795,791 - 150,795,791

commitments

Outstanding cheques of non- 315,525 - 315,525 335,009 - 335,009

resident banks

Spot foreign currency

contract 224,560,300 - 224,560,300 148,265,797 - 148,265,797

Collaterals for loan portfolio 3,861,262,871 - 3,861,262,871 2,419,027,674 - 2,419,027,674

Securities pledged as 343,225,900 - 343,225,900 320,678,295 - 320,678,295

collateral

Total off balance sheet 4,594,148,919 - 4,594,148,919 3,039,102,566 - 3,039,102,566

Total credit risk exposure 10,149,932,308 (70,415,782) 10,079,516,526 8,233,359,078 (71,713,900) 8,161,645,178