Page 102 - BKT Annual Report 2023 EN

P. 102

33 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

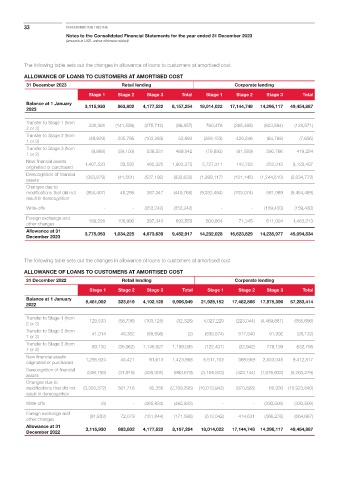

The following table sets out the changes in allowance of loans to customers at amortised cost.

ALLOWANCE OF LOANS TO CUSTOMERS AT AMORTISED COST

31 December 2023 Retail lending Corporate lending

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Balance at 1 January 3,115,930 863,802 4,177,522 8,157,254 18,014,022 17,144,748 14,296,117 49,454,887

2023

Transfer to Stage 1 (from 330,381 (141,526) (275,712) (86,857) 760,478 (265,485) (623,564) (128,571)

2 or 3)

Transfer to Stage 2 (from (49,829) 205,795 (103,283) 52,683 (369,153) 426,246 (64,788) (7,695)

1 or 3)

Transfer to Stage 3 (from (9,889) (39,100) 538,531 489,542 (79,893) (91,589) 590,766 419,284

1 or 2)

New financial assets 1,407,520 33,530 462,325 1,903,375 5,727,311 142,783 252,313 6,122,407

originated or purchased

Derecognition of financial (353,879) (41,561) (537,192) (932,632) (1,289,117) (101,145) (1,244,510) (2,634,772)

assets

Changes due to

modifications that did not (854,407) 46,295 367,347 (440,765) (9,332,484) (703,074) 581,069 (9,454,489)

result in derecognition

Write-offs - - (353,242) (353,242) - - (159,430) (159,430)

Foreign exchange and 189,226 106,990 397,343 693,559 800,864 71,345 611,004 1,483,213

other changes

Allowance at 31 3,775,053 1,034,225 4,673,639 9,482,917 14,232,028 16,623,829 14,238,977 45,094,834

December 2023

The following table sets out the changes in allowance of loans to customers at amortised cost

ALLOWANCE OF LOANS TO CUSTOMERS AT AMORTISED COST

31 December 2022 Retail lending Corporate lending

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Balance at 1 January 5,481,002 323,819 4,102,128 9,906,949 21,925,152 17,482,866 17,875,396 57,283,414

2022

Transfer to Stage 1 (from 129,533 (58,736) (103,125) (32,328) 4,027,229 (223,044) (4,469,881) (665,696)

2 or 3)

Transfer to Stage 2 (from 41,314 48,382 (89,698) (2) (635,574) 517,540 91,902 (26,132)

1 or 3)

Transfer to Stage 3 (from 89,130 (36,962) 1,146,927 1,199,095 (122,401) (22,942) 778,139 632,796

1 or 2)

New financial assets 1,296,924 45,421 81,613 1,423,958 6,511,103 368,669 2,533,045 9,412,817

originated or purchased

Derecognition of financial (526,759) (31,919) (435,001) (993,679) (3,164,503) (422,144) (1,676,632) (5,263,279)

assets

Changes due to

modifications that did not (3,303,372) 501,718 92,356 (2,709,298) (10,013,942) (970,828) 60,930 (10,923,840)

result in derecognition

Write-offs (9) - (465,834) (465,843) - - (330,506) (330,506)

Foreign exchange and (91,833) 72,079 (151,844) (171,598) (513,042) 414,631 (566,276) (664,687)

other changes

Allowance at 31 3,115,930 863,802 4,177,522 8,157,254 18,014,022 17,144,748 14,296,117 49,454,887

December 2022