Page 107 - BKT Annual Report 2023 EN

P. 107

ANNUAL REPORT 2023 38

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

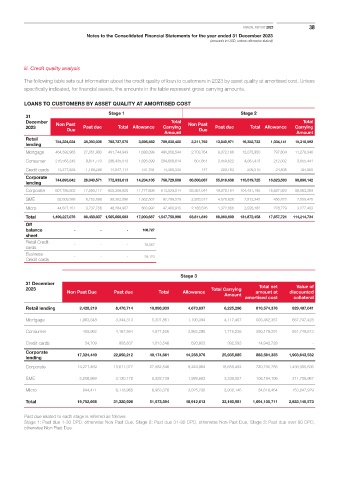

iii. Credit quality analysis

The following table sets out information about the credit quality of loan to customers in 2023 by asset quality at amortised cost. Unless

specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts.

LOANS TO CUSTOMERS BY ASSET QUALITY AT AMORTISED COST

Stage 1 Stage 2

31

December Non Past Total Non Past Total

2023 Past due Total Allowance Carrying Past due Total Allowance Carrying

Due Due

Amount Amount

Retail

lending 754,334,034 38,393,036 792,727,070 3,696,582 789,030,488 3,311,762 13,040,971 16,352,733 1,034,141 15,318,592

Mortgage 464,392,963 27,351,980 491,744,943 1,688,399 490,056,544 2,703,764 9,372,186 12,075,950 797,604 11,278,346

Consumer 276,563,243 9,871,770 286,435,013 1,826,399 284,608,614 607,851 3,459,622 4,067,473 212,032 3,855,441

Credit cards 13,377,828 1,169,286 14,547,114 181,784 14,365,330 147 209,163 209,310 24,505 184,805

Corporate 744,893,042 28,040,571 772,933,613 14,204,105 758,729,508 60,500,087 55,019,638 115,519,725 16,623,583 98,896,142

lending

Corporate 607,756,503 17,550,117 625,306,620 11,777,606 613,529,014 55,381,044 49,070,154 104,451,198 15,887,929 88,563,269

SME 92,609,388 6,752,698 99,362,086 1,562,507 97,799,579 2,935,517 4,576,828 7,512,345 456,875 7,055,470

Micro 44,527,151 3,737,756 48,264,907 863,992 47,400,915 2,183,526 1,372,656 3,556,182 278,779 3,277,403

Total 1,499,227,076 66,433,607 1,565,660,683 17,900,687 1,547,759,996 63,811,849 68,060,609 131,872,458 17,657,724 114,214,734

Off

balance - - - 106,727

sheet

Retail Credit - - - 78,557

cards

Business - - - 28,170

Credit cards

Stage 3

31 December Total net Value of

2023 Total Carrying

Non Past Due Past due Total Allowance amount at discounted

Amount

amortised cost collateral

Retail lending 2,428,219 8,470,714 10,898,933 4,673,637 6,225,296 810,574,376 929,497,041

Mortgage 1,963,548 3,344,313 5,307,861 1,190,394 4,117,467 505,452,357 667,747,428

Consumer 409,962 4,167,564 4,577,526 2,862,290 1,715,236 290,179,291 261,749,613

Credit cards 54,709 958,837 1,013,546 620,953 392,593 14,942,728 -

Corporate

lending 17,324,449 22,850,212 40,174,661 14,238,976 25,935,685 883,561,335 1,903,643,532

Corporate 14,271,469 13,611,077 27,882,546 9,224,064 18,658,482 720,750,765 1,438,085,636

SME 2,208,569 3,120,170 5,328,739 1,989,682 3,339,057 108,194,106 311,709,967

Micro 844,411 6,118,965 6,963,376 3,025,230 3,938,146 54,616,464 153,847,929

Total 19,752,668 31,320,926 51,073,594 18,912,613 32,160,981 1,694,135,711 2,833,140,573

Past due related to each stage is referred as follows:

Stage 1: Past due 1-30 DPD, otherwise Non Past Due, Stage 2: Past due 31-90 DPD, otherwise Non Past Due, Stage 3: Past due over 90 DPD,

otherwise Non Past Due.