Page 145 - BKT Annual Report 2023 EN

P. 145

ANNUAL REPORT 2023 76

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

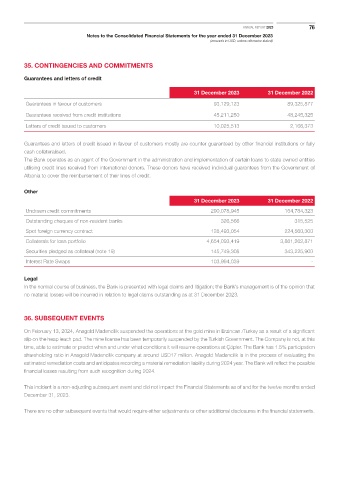

35. CONTINGENCIES AND COMMITMENTS

Guarantees and letters of credit

31 December 2023 31 December 2022

Guarantees in favour of customers 93,129,123 89,325,877

Guarantees received from credit institutions 45,211,250 48,245,325

Letters of credit issued to customers 10,025,513 2,166,373

Guarantees and letters of credit issued in favour of customers mostly are counter guaranteed by other financial institutions or fully

cash collateralised.

The Bank operates as an agent of the Government in the administration and implementation of certain loans to state owned entities

utilising credit lines received from international donors. These donors have received individual guarantees from the Government of

Albania to cover the reimbursement of their lines of credit.

Other

31 December 2023 31 December 2022

Undrawn credit commitments 290,078,945 164,784,323

Outstanding cheques of non-resident banks 326,566 315,525

Spot foreign currency contract 128,493,054 224,560,300

Collaterals for loan portfolio 4,654,093,419 3,861,262,871

Securities pledged as collateral (note 19) 145,749,308 343,225,900

Interest Rate Swaps 103,994,039 -

Legal

In the normal course of business, the Bank is presented with legal claims and litigation; the Bank’s management is of the opinion that

no material losses will be incurred in relation to legal claims outstanding as at 31 December 2023.

36. SUBSEQUENT EVENTS

On February 13, 2024, Anagold Madencilik suspended the operations at the gold mine in Erzincan /Turkey as a result of a significant

slip on the heap leach pad. The mine license has been temporarily suspended by the Turkish Government. The Company is not, at this

time, able to estimate or predict when and under what conditions it will resume operations at Çöpler. The Bank has 1.5% participation

shareholding ratio in Anagold Madencilik company at around USD17 million. Anagold Madencilik is in the process of evaluating the

estimated remediation costs and anticipates recording a material remediation liability during 2024 year. The Bank will reflect the possible

financial losses resulting from such recognition during 2024.

This incident is a non-adjusting subsequent event and did not impact the Financial Statements as of and for the twelve months ended

December 31, 2023.

There are no other subsequent events that would require either adjustments or other additional disclosures in the financial statements.