Page 140 - BKT Annual Report 2023 EN

P. 140

71 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

available-for-sale securities impairment provision at USD 44,390,980 (31 December 2022: USD 32,847,021) and treasury bills available-

for-sale impairment provision at USD 24,994 (31 December 2022: USD 176,779).

Retained earnings

Retained earnings as at 31 December 2023, includes the cumulative non distributed earnings. As described in Note 1, the Bank created

legal reserves of Lek 407,586 thousand (equivalent of USD 3,906,700) and decided to distribute Lek 5,216,500 thousand (equivalent of

USD 50,000,000) as dividends, using part of the statutory net profit for the year ended December 31, 2022 and part of the net profit of

the year 2021. The remaining part of statutory profit for the year 2022 was kept as retained earnings. Retained earnings are distributable.

Retained earnings include the amount 9,887,370 USD representing the revaluation surplus, net of taxes, created for the ex-Head

Office property which was sold in 2022 year at the revaluated amount, in accordance with the requirements of IAS 16 “Property, plant

and equipment”.

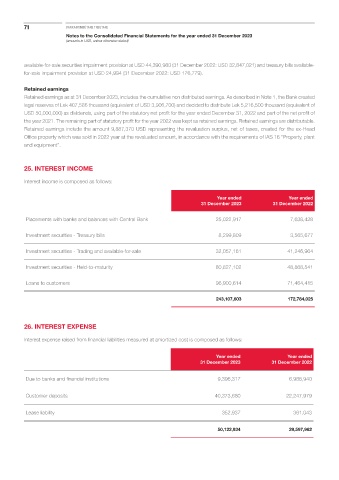

25. INTEREST INCOME

Interest income is composed as follows:

Year ended Year ended

31 December 2023 31 December 2022

Placements with banks and balances with Central Bank 25,022,917 7,638,428

Investment securities - Treasury bills 8,299,809 3,565,677

Investment securities - Trading and available-for-sale 32,057,161 41,246,964

Investment securities - Held-to-maturity 80,827,102 48,868,541

Loans to customers 96,900,614 71,464,415

243,107,603 172,784,025

26. INTEREST EXPENSE

Interest expense raised from financial liabilities measured at amortized cost is composed as follows:

Year ended Year ended

31 December 2023 31 December 2022

Due to banks and financial institutions 9,396,317 6,988,940

Customer deposits 40,373,680 22,247,979

Lease liability 352,937 361,043

50,122,934 29,597,962