Page 143 - BKT Annual Report 2023 EN

P. 143

ANNUAL REPORT 2023 74

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

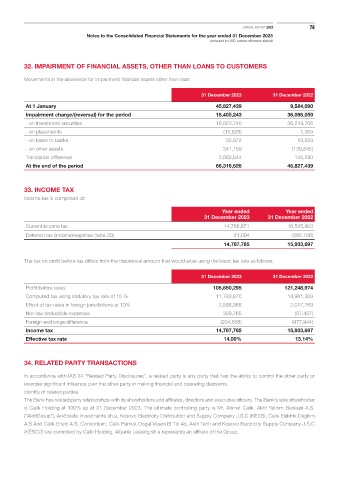

32. IMPAIRMENT OF FINANCIAL ASSETS, OTHER THAN LOANS TO CUSTOMERS

Movements in the allowance for impairment financial assets other than loan:

31 December 2023 31 December 2022

At 1 January 45,827,439 9,584,090

Impairment charge/(reversal) for the period 18,405,243 36,098,059

- on investment securities 18,023,740 36,219,706

- on placements (15,628) 7,369

- on loans to banks 55,972 10,829

- on other assets 341,159 (139,845)

Translation difference 2,083,844 145,290

At the end of the period 66,316,526 45,827,439

33. INCOME TAX

Income tax is comprised of:

Year ended Year ended

31 December 2023 31 December 2022

Current income tax 14,766,671 16,515,803

Deferred tax (income)/expense (note 20) 21,094 (582,106)

14,787,765 15,933,697

The tax on profit before tax differs from the theoretical amount that would arise using the basic tax rate as follows:

31 December 2023 31 December 2022

Profit before taxes 105,650,295 121,248,974

Computed tax using statutory tax rate of 15 % 11,783,870 14,961,309

Effect of tax rates in foreign jurisdictions at 10% 2,898,968 2,017,769

Non tax deductible expenses 309,765 (67,437)

Foreign exchange difference (204,838) (977,944)

Income tax 14,787,765 15,933,697

Effective tax rate 14.00% 13.14%

34. RELATED PARTY TRANSACTIONS

In accordance with IAS 24 “Related Party Disclosures”, a related party is any party that has the ability to control the other party or

exercise significant influence over the other party in making financial and operating decisions.

Identity of related parties

The Bank has related party relationships with its shareholders and affiliates, directors and executive officers. The Bank’s sole shareholder

is Calik Holding at 100% as at 31 December 2023. The ultimate controlling party is Mr. Ahmet Calik. Aktif Yatirim Bankasi A.S.

(“AktifGroup”), ArkEstate Investments sh.a, Kosovo Electricity Distribution and Supply Company J.S.C (KEDS), Calik Elektrik Dagitim

A.S And Calik Enerji A.S. Consortium, Calik Pamuk Dogal Vesen El Tic As, Aktif Tech and Kosovo Electricity Supply Company J.S.C

(KESCO) are controlled by Calik Holding. Albania Leasing sh.a represents an affiliate of the Group.