Page 81 - BKT Annual Report 2023 EN

P. 81

ANNUAL REPORT 2023 12

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

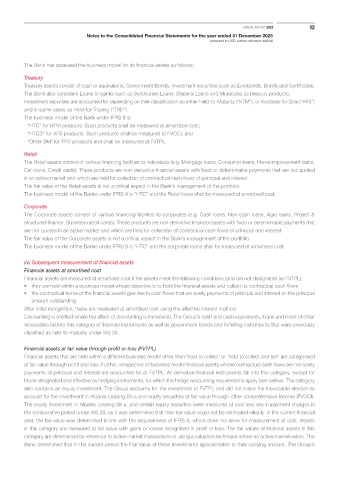

The Bank has assessed the business model for its financial assets as follows;

Treasury

Treasury assets consist of cash or equivalents, Government Bonds, Investment securities such as Eurobonds, Bonds and Certificates.

The Bank also considers Loans to banks such as Syndicated Loans, Bilateral Loans and Murabaha as treasury products.

Investment securities are accounted for depending on their classification as either Held-to-Maturity (“HTM”), or Available-for-Sale (“AFS”)

and in some cases as Held-for-Trading (“TRD”).

The business model of the Bank under IFRS 9 is:

- “HTC” for HTM products. Such products shall be measured at amortised cost;

- “HTCS” for AFS products. Such products shall be measured at FVOCI; and

- “Other BM” for TRD products and shall be measured at FVTPL.

Retail

The Retail assets consist of various financing facilities to individuals (e.g. Mortgage loans, Consumer loans, Home improvement loans,

Car loans, Credit cards). These products are non-derivative financial assets with fixed or determinable payments that are not quoted

in an active market and which are held for collection of contractual cash flows of principal and interest.

The fair value of the Retail assets is not a critical aspect in the Bank’s management of the portfolio.

The business model of the Banks under IFRS 9 is “HTC” and the Retail loans shall be measured at amortised cost.

Corporate

The Corporate assets consist of various financing facilities to corporates (e.g. Cash loans, Non-cash loans, Agro loans, Project &

structured finance, Business credit cards). These products are non-derivative financial assets with fixed or determinable payments that

are not quoted in an active market and which are held for collection of contractual cash flows of principal and interest.

The fair value of the Corporate assets is not a critical aspect in the Bank’s management of the portfolio.

The business model of the Banks under IFRS 9 is “HTC” and the corporate loans shall be measured at amortised cost.

(iv) Subsequent measurement of financial assets

Financial assets at amortised cost

Financial assets are measured at amortised cost if the assets meet the following conditions (and are not designated as FVTPL):

• they are held within a business model whose objective is to hold the financial assets and collect its contractual cash flows

• the contractual terms of the financial assets give rise to cash flows that are solely payments of principal and interest on the principal

amount outstanding

After initial recognition, these are measured at amortised cost using the effective interest method.

Discounting is omitted where the effect of discounting is immaterial. The Group’s cash and cash equivalents, loans and most of other

receivables fall into this category of financial instruments as well as government bonds and forfeiting instruments that were previously

classified as held-to-maturity under IAS 39.

Financial assets at fair value through profit or loss (FVTPL)

Financial assets that are held within a different business model other than ‘hold to collect’ or ‘hold to collect and sell’ are categorised

at fair value through profit and loss. Further, irrespective of business model financial assets whose contractual cash flows are not solely

payments of principal and interest are accounted for at FVTPL. All derivative financial instruments fall into this category, except for

those designated and effective as hedging instruments, for which the hedge accounting requirements apply (see below). The category

also contains an equity investment. The Group accounts for the investment at FVTPL and did not make the irrevocable election to

account for the investment in Albania Leasing Sh.a and equity securities at fair value through other comprehensive income (FVOCI).

The equity investment in Albania Leasing Sh.a. and certain equity securities were measured at cost less any impairment charges in

the comparative period under IAS 39, as it was determined that their fair value could not be estimated reliably. In the current financial

year, the fair value was determined in line with the requirements of IFRS 9, which does not allow for measurement at cost. Assets

in this category are measured at fair value with gains or losses recognised in profit or loss. The fair values of financial assets in this

category are determined by reference to active market transactions or using a valuation technique where no active market exists. The

Bank determined that in the current period the Fair Value of these investments approximates to their carrying amount. The Group’s