Page 83 - BKT Annual Report 2023 EN

P. 83

ANNUAL REPORT 2023 14

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

Paragraph 4.4.1 requires an entity to reclassify financial assets if the entity changes its business model for managing those financial

assets. Such changes are expected to be very infrequent. Such changes are determined by the entity’s senior management as a result

of external or internal changes and must be significant to the entity’s operations and demonstrable to external parties.

Accordingly, based on the accounting requirements for asset reclassifications from FVOCI to Amortized Cost, any cumulative gain

or loss previously recognized in OCI has been removed from equity and applied against the fair value of the financial asset at the

reclassification date.

The reclassification of securities has been also performed in accordance with the requirements of financial reporting methodology and

accounting manual of the Bank of Albania, sections 3.2.2 and 3.2.3, by also meeting the liquidity requirements through the eligibility

criteria applied for these financial assets.

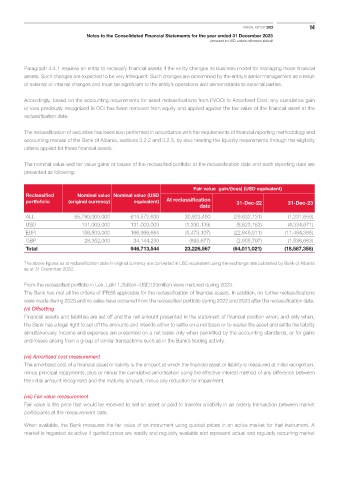

The nominal value and fair value gains or losses of the reclassified portfolio at the reclassification date and each reporting date are

presented as following:

Fair value gain/(loss) (USD equivalent)

Reclassified Nominal value Nominal value (USD

portfofolio (original currency) equivalent) At reclassification 31-Dec-22 31-Dec-23

date

ALL 65,790,000,000 614,572,630 30,923,490 (29,632,131) (1,231,659)

USD 131,000,000 131,000,000 (1,330,139) (8,623,182) (4,334,671)

EUR 156,500,000 166,996,684 (5,473,107) (22,849,911) (11,484,365)

GBP 28,352,000 34,144,230 (893,677) (2,905,797) (1,536,663)

Total 946,713,544 23,226,567 (64,011,021) (18,587,358)

The above figures as at reclassification date in original currency are converted in USD equivalent using the exchange rate published by Bank of Albania

as at 31 December 2022.

From the reclassified portfolio in Lek, Lek11.3billion~USD120million were matured during 2023.

The Bank has met all the criteria of IFRS9 applicable for the reclassification of financial assets. In addition, no further reclassifications

were made during 2023 and no sales have occurred from the reclassified portfolio during 2022 and 2023 after the reclassification date.

(vi) Offsetting

Financial assets and liabilities are set off and the net amount presented in the statement of financial position when, and only when,

the Bank has a legal right to set off the amounts and intends either to settle on a net basis or to realise the asset and settle the liability

simultaneously. Income and expenses are presented on a net basis only when permitted by the accounting standards, or for gains

and losses arising from a group of similar transactions such as in the Bank’s trading activity.

(vii) Amortised cost measurement

The amortised cost of a financial asset or liability is the amount at which the financial asset or liability is measured at initial recognition,

minus principal repayments, plus or minus the cumulative amortisation using the effective interest method of any difference between

the initial amount recognised and the maturity amount, minus any reduction for impairment.

(viii) Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market

participants at the measurement date.

When available, the Bank measures the fair value of an instrument using quoted prices in an active market for that instrument. A

market is regarded as active if quoted prices are readily and regularly available and represent actual and regularly occurring market