Page 86 - BKT Annual Report 2023 EN

P. 86

17 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

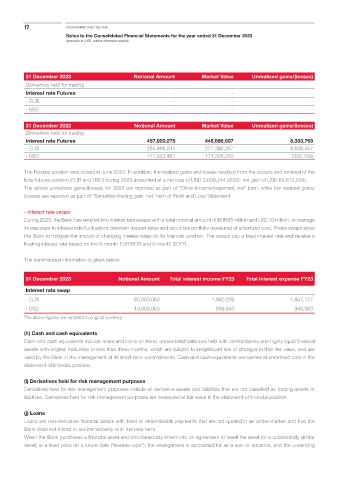

31 December 2023 Notional Amount Market Value Unrealized gains/(losses)

Derivatives held for trading

Interest rate Futures - - -

- EUR - - -

- USD - - -

31 December 2022 Notional Amount Market Value Unrealized gains/(losses)

Derivatives held for trading

Interest rate Futures 457,020,275 448,686,507 8,333,768

- EUR 285,996,814 277,360,257 8,636,557

- USD 171,023,461 171,326,250 (302,789)

The Futures position was closed in June 2023. In addition, the realized gains and losses resulted from the closure and renewal of the

total futures position (EUR and USD) during 2023 amounted at a net loss of USD 3,009,244 (2022: net gain of USD 64,612,634).

The above unrealized gains/(losses) for 2022 are reported as part of “Other income/(expense), net” item, while the realized gains/

(losses) are reported as part of “Securities trading gain, net” item of Profit and Loss Statement.

- Interest rate swaps

During 2023, the Bank has entered into interest rate swaps with a total notional amount of EUR85 million and USD10 million, to manage

its exposure to interest rate fluctuations between deposit rates and securities portfolio measured at amortized cost. These swaps allow

the Bank to mitigate the impact of changing interest rates on its financial position. The swaps pay a fixed interest rate and receive a

floating interest rate based on the 6-month EURIBOR and 6-month SOFR.

The summarized information is given below:

31 December 2023 Notional Amount Total interest income FY23 Total interest expense FY23

Interest rate swap

- EUR 85,000,000 1,990,206 1,837,127

- USD 10,000,000 939,840 946,953

The above figures are reported in original currency.

(h) Cash and cash equivalents

Cash and cash equivalents include notes and coins on hand, unrestricted balances held with central banks and highly liquid financial

assets with original maturities of less than three months, which are subject to insignificant risk of changes in their fair value, and are

used by the Bank in the management of its short-term commitments. Cash and cash equivalents are carried at amortised cost in the

statement of financial position.

(i) Derivatives held for risk management purposes

Derivatives held for risk management purposes include all derivative assets and liabilities that are not classified as trading assets or

liabilities. Derivatives held for risk management purposes are measured at fair value in the statement of financial position.

(j) Loans

Loans are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market and that the

Bank does not intend to sell immediately or in the near term.

When the Bank purchases a financial asset and simultaneously enters into an agreement to resell the asset (or a substantially similar

asset) at a fixed price on a future date (“reverse repo”), the arrangement is accounted for as a loan or advance, and the underlying