Page 101 - Annual Report 2022

P. 101

39 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

ii Expected credit loss measurement (continued)

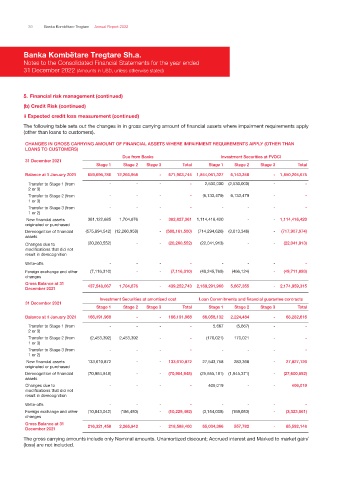

The following table sets out the changes in in gross carrying amount of financial assets where impairment requirements apply

(other than loans to customers).

CHANGES IN GROSS CARRYING AMOUNT OF FINANCIAL ASSETS WHERE IMPAIRMENT REQUIREMENTS APPLY (OTHER THAN

LOANS TO CUSTOMERS)

Due from Banks Investment Securities at FVOCI

31 December 2021

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Balance at 1 January 2021 659,696,786 12,266,958 - 671,963,744 1,844,061,327 6,143,348 - 1,850,204,675

Transfer to Stage 1 (from - - - - 2,530,000 (2,530,000) - -

2 or 3)

Transfer to Stage 2 (from - - - - (6,133,479) 6,133,479 - -

1 or 3)

Transfer to Stage 3 (from - - - - - - - -

1 or 2)

New financial assets 381,122,685 1,704,676 - 382,827,361 1,114,416,420 - - 1,114,416,420

originated or purchased

Derecognition of financial (575,894,542) (12,266,958) - (588,161,500) (714,294,626) (3,613,348) - (717,907,974)

assets

Changes due to (20,260,552) - - (20,260,552) (22,041,913) - - (22,041,913)

modifications that did not

result in derecognition

Write-offs - - - - - - - -

Foreign exchange and other (7,116,310) - - (7,116,310) (49,245,769) (466,124) - (49,711,893)

changes

Gross Balance at 31 437,548,067 1,704,676 - 439,252,743 2,169,291,960 5,667,355 - 2,174,959,315

December 2021

Investment Securities at amortised cost Loan Commitments and financial guarantee contracts

31 December 2021

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Balance at 1 January 2021 166,191,968 - - 166,191,968 66,058,132 2,224,484 - 68,282,616

Transfer to Stage 1 (from - - - - 5,667 (5,667) - -

2 or 3)

Transfer to Stage 2 (from (2,453,392) 2,453,392 - - (170,021) 170,021 - -

1 or 3)

Transfer to Stage 3 (from - - - - - - - -

1 or 2)

New financial assets 133,610,872 - - 133,610,872 27,543,758 283,368 - 27,827,126

originated or purchased

Derecognition of financial (70,984,948) - - (70,984,948) (25,655,181) (1,945,371) - (27,600,552)

assets

Changes due to - - - - 406,019 - - 406,019

modifications that did not

result in derecognition

Write-offs - - - - - - - -

Foreign exchange and other (10,043,042) (186,450) - (10,229,492) (3,154,008) (169,053) - (3,323,061)

changes

Gross Balance at 31 216,321,458 2,266,942 - 218,588,400 65,034,366 557,782 - 65,592,148

December 2021

The gross carrying amounts include only Nominal amounts. Unamortized discount; Accrued interest and Marked to market gain/

(loss) are not included.