Page 104 - Annual Report 2022

P. 104

Banka Kombëtare Tregtare Annual Report 2022 42

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

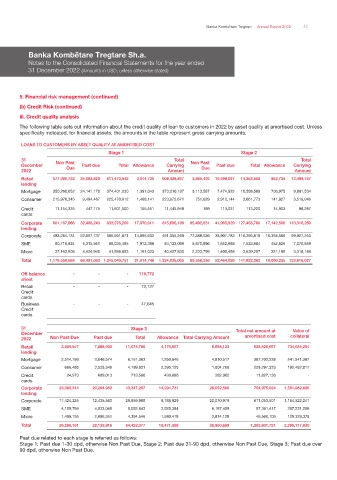

iii. Credit quality analysis

The following table sets out information about the credit quality of loan to customers in 2022 by asset quality at amortised cost. Unless

specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts.

LOANS TO CUSTOMERS BY ASSET QUALITY AT AMORTISED COST

Stage 1 Stage 2

31 Non Past Total Non Past Total

December Past due Total Allowance Carrying Past due Total Allowance Carrying

2022 Due Amount Due Amount

Retail 577,390,722 34,082,820 611,473,542 3,044,735 608,428,807 3,865,405 10,498,097 14,363,502 863,735 13,499,767

lending

Mortgage 350,260,052 24,141,178 374,401,230 1,391,043 373,010,187 3,113,587 7,474,922 10,588,509 706,975 9,881,534

Consumer 215,976,345 9,494,467 225,470,812 1,498,141 223,972,671 751,629 2,910,144 3,661,773 141,827 3,519,946

Credit 11,154,325 447,175 11,601,500 155,551 11,445,949 189 113,031 113,220 14,933 98,287

cards

Corporate 601,167,966 32,408,243 633,576,209 17,970,011 615,606,198 85,492,831 41,965,929 127,458,760 17,142,500 110,316,260

lending

Corporate 483,284,134 22,667,737 505,951,871 14,896,602 491,055,269 77,388,036 38,907,783 116,295,819 16,368,566 99,927,253

SME 80,719,924 5,315,561 86,035,485 1,912,386 84,123,099 5,870,996 1,652,688 7,523,684 452,825 7,070,859

Micro 37,163,908 4,424,945 41,588,853 1,161,023 40,427,830 2,233,799 1,405,458 3,639,257 321,109 3,318,148

Total 1,178,558,688 66,491,063 1,245,049,751 21,014,746 1,224,035,005 89,358,236 52,464,026 141,822,262 18,006,235 123,816,027

Off balance - - - 119,772

sheet

Retail - - - 72,127

Credit

cards

Business - - - 47,645

Credit

cards

31 Stage 3 Total net amount at Value of

December amortised cost collateral

2022 Non Past Due Past due Total Allowance Total Carrying Amount

Retail 3,205,847 7,868,933 11,074,780 4,176,657 6,898,123 628,826,697 734,034,204

lending

Mortgage 2,514,789 3,646,574 6,161,363 1,350,846 4,810,517 387,702,238 541,541,387

Consumer 666,485 3,533,346 4,199,831 2,395,125 1,804,706 229,297,323 192,492,817

Credit 24,573 689,013 713,586 430,686 282,900 11,827,136 -

cards

Corporate 23,082,314 20,264,983 43,347,297 14,294,731 29,052,566 754,975,024 1,561,082,826

lending

Corporate 17,424,325 12,435,583 29,859,908 9,788,929 20,070,979 611,053,501 1,164,522,241

SME 4,159,794 4,933,049 9,092,843 2,925,384 6,167,459 97,361,417 267,231,206

Micro 1,498,195 2,896,351 4,394,546 1,580,418 2,814,128 46,560,106 129,329,379

Total 26,288,161 28,133,916 54,422,077 18,471,388 35,950,689 1,383,801,721 2,295,117,030

Past due related to each stage is referred as follows:

Stage 1: Past due 1-30 dpd, otherwise Non Past Due, Stage 2: Past due 31-90 dpd, otherwise Non Past Due, Stage 3: Past due over

90 dpd, otherwise Non Past Due.