Page 105 - Annual Report 2022

P. 105

43 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

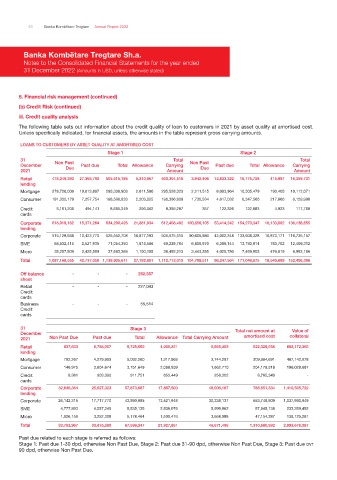

iii. Credit quality analysis

The following table sets out information about the credit quality of loan to customers in 2021 by asset quality at amortised cost.

Unless specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts.

LOANS TO CUSTOMERS BY ASSET QUALITY AT AMORTISED COST

Stage 1 Stage 2

31 Non Past Total Non Past Total

December Past due Total Allowance Carrying Past due Total Allowance Carrying

2021 Due Amount Due Amount

Retail 478,249,393 27,365,792 505,615,185 5,310,667 500,304,518 3,942,406 12,833,322 16,775,728 415,997 16,359,731

lending

Mortgage 278,726,006 19,613,897 298,339,903 2,811,580 295,528,323 2,211,515 8,093,964 10,305,479 193,408 10,112,071

Consumer 191,332,179 7,257,754 198,589,933 2,203,025 196,386,908 1,730,534 4,617,032 6,347,566 217,666 6,129,990

Credit 8,191,208 494,141 8,685,349 296,062 8,389,287 357 122,326 122,683 4,923 117,760

cards

Corporate 618,919,162 15,371,264 634,290,426 21,881,934 612,408,492 100,856,105 53,414,242 154,270,347 18,133,692 136,136,655

lending

Corporate 515,128,938 10,423,770 525,552,708 18,877,193 506,675,515 90,605,980 43,002,348 133,608,328 16,873,171 116,735,157

SME 68,532,415 2,521,935 71,054,350 1,814,586 69,239,764 6,806,870 6,386,144 13,193,014 783,702 12,409,312

Micro 35,257,809 2,425,559 37,683,368 1,190,155 36,493,213 3,443,255 4,025,750 7,469,005 476,819 6,992,186

Total 1,097,168,555 42,737,056 1,139,905,611 27,192,601 1,112,713,010 104,798,511 66,247,564 171,046,075 18,549,689 152,496,386

Off balance - - - 282,557

sheet

Retail - - - 227,043

Credit

cards

Business - - - 55,514

Credit

cards

31 Stage 3 Total net amount at Value of

December amortised cost collateral

2021 Non Past Due Past due Total Allowance Total Carrying Amount

Retail 937,603 8,788,057 9,725,660 4,060,351 5,665,309 522,329,558 683,172,365

lending

Mortgage 782,267 4,279,993 5,062,260 1,317,963 3,744,297 309,384,691 487,142,678

Consumer 146,975 3,604,674 3,751,649 2,088,939 1,662,710 204,179,518 196,029,687

Credit 8,361 903,390 911,751 653,449 258,302 8,765,349 -

cards

Corporate 32,846,364 25,027,323 57,873,687 17,867,500 40,006,187 788,551,334 1,410,505,722

lending

Corporate 26,142,315 17,717,770 43,860,085 13,521,948 30,338,137 653,748,809 1,037,990,949

SME 4,777,893 4,057,245 8,835,138 2,836,076 5,999,062 87,648,138 233,389,492

Micro 1,926,156 3,252,308 5,178,464 1,509,476 3,668,988 47,154,387 139,125,281

Total 33,783,967 33,815,380 67,599,347 21,927,851 45,671,496 1,310,880,892 2,093,678,087

Past due related to each stage is referred as follows:

Stage 1: Past due 1-30 dpd, otherwise Non Past Due, Stage 2: Past due 31-90 dpd, otherwise Non Past Due, Stage 3: Past due ovr

90 dpd, otherwise Non Past Due.