Page 138 - BKT Annual Report 2023 EN

P. 138

69 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

Treasury bills and Albanian Government Bonds and Securities with a total value of USD 145,749,308 (31 December 2022: USD

343,225,900) were used to secure Repo agreements and borrowings from banks.

Deposits from banks as at 31 December 2023 represent short-term borrowings obtained from resident and non-resident banks.

Borrowing from financial institutions represents borrowings of EUR 4,444,444 outstanding as at 31 December 2023 (31 December

2022: EUR 8,888,889), which are disbursed from EFSE (European Fund for Southeast Europe) and GGF (Green for Growth Fund

Southeast) to BKT Kosovo, bearing interest rates between 6.20% - 6.30%.

19. DUE TO THIRD PARTIES

The Bank acts as an agent for the tax authorities, either in the collection of taxes or in performing advance payments for the budget.

In return, the Bank charges a commission to the taxpayers for the service rendered. The credit balance as at 31 December 2023 of

USD 8,138,846 (31 December 2022: USD 4,294,958) represents the net outstanding amount of payments and collections made by

the Bank to and from third parties, on behalf of tax authorities.

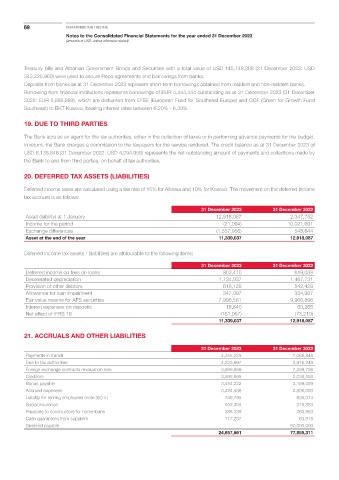

20. DEFERRED TAX ASSETS (LIABILITIES)

Deferred income taxes are calculated using a tax rate of 15% for Albania and 10% for Kosovo. The movement on the deferred income

tax account is as follows:

31 December 2023 31 December 2022

Asset (liability) at 1 January 12,918,087 2,347,752

Income for the period (21,094) 10,021,691

Exchange differences (1,557,956) 548,644

Asset at the end of the year 11,339,037 12,918,087

Deferred income tax assets / (liabilities) are attributable to the following items:

31 December 2023 31 December 2022

Deferred income on fees on loans 803,410 619,039

Decelerated depreciation 1,734,037 1,467,731

Provision of other debtors 618,129 542,429

Allowance for loan impairment 347,097 334,937

Fair value reserve for AFS securities 7,998,581 9,966,896

Interest expenses on deposits 18,840 60,265

Net effect of IFRS 16 (181,057) (73,210)

11,339,037 12,918,087

21. ACCRUALS AND OTHER LIABILITIES

31 December 2023 31 December 2022

Payments in transit 4,355,225 7,066,845

Due to tax authorities 4,223,697 3,916,249

Foreign exchange contracts revaluation loss 3,899,869 7,259,738

Creditors 3,595,665 2,038,558

Bonus payable 3,454,222 3,189,089

Accrued expenses 3,424,438 2,806,093

Liability for retiring employees (note 3(s).ii.) 749,795 835,074

Social insurance 452,204 315,884

Payables to constructors for home loans 385,339 363,963

Cash guarantees from suppliers 117,207 63,818

Dividend payable - 50,000,000

24,657,661 77,855,311