Page 124 - Annual Report 2022

P. 124

Banka Kombëtare Tregtare Annual Report 2022 62

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(d) Market risk (continued)

1) Foreign currency risk (continued)

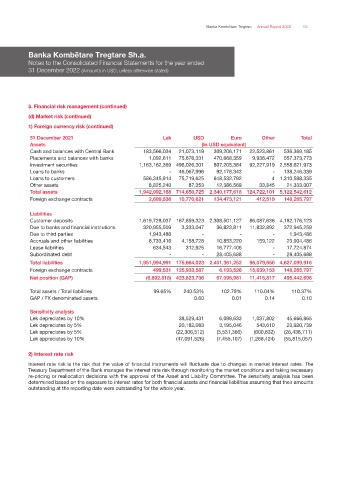

31 December 2021 Lek USD Euro Other Total

Assets (In USD equivalent)

Cash and balances with Central Bank 183,566,034 21,073,119 309,206,171 22,523,861 536,369,185

Placements and balances with banks 1,092,611 75,676,331 470,668,359 9,936,472 557,373,773

Investment securities 1,163,162,369 496,026,301 807,205,384 92,227,919 2,558,621,973

Loans to banks - 46,067,996 92,178,343 - 138,246,339

Loans to customers 586,345,914 75,719,625 648,532,792 4 1,310,598,335

Other assets 8,825,240 87,353 12,386,569 33,845 21,333,007

Total assets 1,942,992,168 714,650,725 2,340,177,618 124,722,101 5,122,542,612

Foreign exchange contracts 2,609,536 10,770,621 134,473,121 412,519 148,265,797

Liabilities

Customer deposits 1,619,728,037 167,859,323 2,308,501,127 86,087,636 4,182,176,123

Due to banks and financial institutions 320,955,509 3,333,047 36,823,811 11,832,892 372,945,259

Due to third parties 1,943,486 - - - 1,943,486

Accruals and other liabilities 8,733,416 4,158,728 10,853,220 159,122 23,904,486

Lease liabilities 634,543 312,925 16,777,406 - 17,724,874

Subordinated debt - - 28,405,688 - 28,405,688

Total liabilities 1,951,994,991 175,664,023 2,401,361,252 98,079,650 4,627,099,916

Foreign exchange contracts 499,531 125,933,587 6,193,526 15,639,153 148,265,797

Net position (GAP) (6,892,818) 423,823,736 67,095,961 11,415,817 495,442,696

Total assets / Total liabilities 99.65% 240.53% 102.79% 110.04% 110.37%

GAP / FX denominated assets 0.60 0.01 0.14 0.10

Sensitivity analysis

Lek depreciates by 10% 38,529,431 6,099,633 1,037,802 45,666,865

Lek depreciates by 5% 20,182,083 3,195,046 543,610 23,920,739

Lek appreciates by 5% (22,306,512) (3,531,366) (600,832) (26,438,711)

Lek appreciates by 10% (47,091,526) (7,455,107) (1,268,424) (55,815,057)

2) Interest rate risk

Interest rate risk is the risk that the value of financial instruments will fluctuate due to changes in market interest rates. The

Treasury Department of the Bank manages the interest rate risk through monitoring the market conditions and taking necessary

re-pricing or reallocation decisions with the approval of the Asset and Liability Committee. The sensitivity analysis has been

determined based on the exposure to interest rates for both financial assets and financial liabilities assuming that their amounts

outstanding at the reporting date were outstanding for the whole year.