Page 125 - Annual Report 2022

P. 125

63 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(d) Market risk (continued)

2) Interest rate risk (continued)

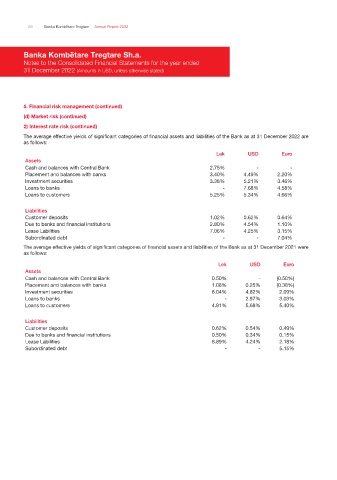

The average effective yields of significant categories of financial assets and liabilities of the Bank as at 31 December 2022 are

as follows:

Lek USD Euro

Assets

Cash and balances with Central Bank 2.75% - -

Placement and balances with banks 3.40% 4.49% 2.20%

Investment securities 3.38% 5.21% 3.46%

Loans to banks - 7.68% 4.58%

Loans to customers 5.25% 5.34% 4.66%

Liabilities

Customer deposits 1.02% 0.62% 0.64%

Due to banks and financial institutions 2.80% 4.54% 1.10%

Lease Labilities 7.06% 4.25% 3.15%

Subordinated debt - - 7.04%

The average effective yields of significant categories of financial assets and liabilities of the Bank as at 31 December 2021 were

as follows:

Lek USD Euro

Assets

Cash and balances with Central Bank 0.50% - (0.50%)

Placement and balances with banks 1.08% 0.25% (0.38%)

Investment securities 6.04% 4.82% 2.09%

Loans to banks - 2.97% 3.03%

Loans to customers 4.91% 5.68% 5.40%

Liabilities

Customer deposits 0.62% 0.54% 0.49%

Due to banks and financial institutions 0.50% 0.34% 0.15%

Lease Labilities 6.89% 4.24% 2.18%

Subordinated debt - - 5.15%