Page 128 - Annual Report 2022

P. 128

Banka Kombëtare Tregtare Annual Report 2022 66

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(d) Market risk (continued)

2) Interest rate risk (continued)

Interest rate sensitivity

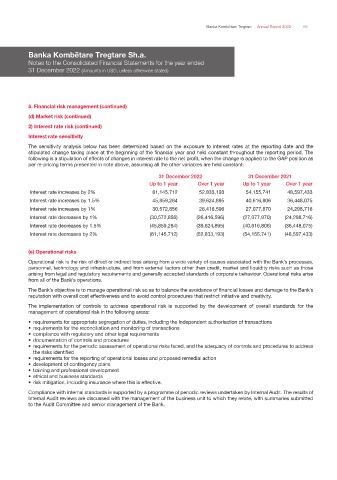

The sensitivity analysis below has been determined based on the exposure to interest rates at the reporting date and the

stipulated change taking place at the beginning of the financial year and held constant throughout the reporting period. The

following is a stipulation of effects of changes in interest rate to the net profit, when the change is applied to the GAP position as

per re-pricing terms presented in note above, assuming all the other variables are held constant:

31 December 2022 31 December 2021

Up to 1 year Over 1 year Up to 1 year Over 1 year

Interest rate increases by 2% 61,145,712 52,833,193 54,155,741 48,597,433

Interest rate increases by 1.5% 45,859,284 39,624,895 40,616,806 36,448,075

Interest rate increases by 1% 30,572,856 26,416,596 27,077,870 24,298,716

Interest rate decreases by 1% (30,572,856) (26,416,596) (27,077,870) (24,298,716)

Interest rate decreases by 1.5% (45,859,284) (39,624,895) (40,616,806) (36,448,075)

Interest rate decreases by 2% (61,145,712) (52,833,193) (54,155,741) (48,597,433)

(e) Operational risks

Operational risk is the risk of direct or indirect loss arising from a wide variety of causes associated with the Bank’s processes,

personnel, technology and infrastructure, and from external factors other than credit, market and liquidity risks such as those

arising from legal and regulatory requirements and generally accepted standards of corporate behaviour. Operational risks arise

from all of the Bank’s operations.

The Bank’s objective is to manage operational risk so as to balance the avoidance of financial losses and damage to the Bank’s

reputation with overall cost effectiveness and to avoid control procedures that restrict initiative and creativity.

The implementation of controls to address operational risk is supported by the development of overall standards for the

management of operational risk in the following areas:

• requirements for appropriate segregation of duties, including the independent authorisation of transactions

• requirements for the reconciliation and monitoring of transactions

• compliance with regulatory and other legal requirements

• documentation of controls and procedures

• requirements for the periodic assessment of operational risks faced, and the adequacy of controls and procedures to address

the risks identified

• requirements for the reporting of operational losses and proposed remedial action

• development of contingency plans

• training and professional development

• ethical and business standards

• risk mitigation, including insurance where this is effective.

Compliance with internal standards is supported by a programme of periodic reviews undertaken by Internal Audit. The results of

Internal Audit reviews are discussed with the management of the business unit to which they relate, with summaries submitted

to the Audit Committee and senior management of the Bank.