Page 148 - Annual Report 2022

P. 148

Banka Kombëtare Tregtare Annual Report 2022 86

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

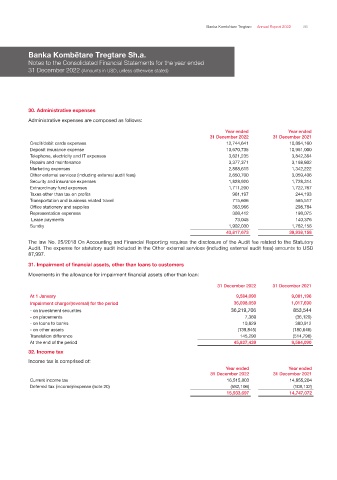

30. Administrative expenses

Administrative expenses are composed as follows:

Year ended Year ended

31 December 2022 31 December 2021

Credit/debit cards expenses 12,744,641 10,884,160

Deposit insurance expense 10,670,735 10,961,000

Telephone, electricity and IT expenses 3,621,235 3,842,384

Repairs and maintenance 3,377,371 3,168,802

Marketing expenses 2,888,615 1,342,222

Other external services (including external audit fees) 2,650,700 3,059,406

Security and insurance expenses 1,828,920 1,728,314

Extraordinary fund expenses 1,711,200 1,722,767

Taxes other than tax on profits 961,197 244,193

Transportation and business related travel 715,606 565,517

Office stationery and supplies 363,966 298,784

Representation expenses 308,412 198,075

Lease payments 73,045 140,376

Sundry 1,902,030 1,782,158

43,817,673 39,938,158

The law No. 25/2018 On Accounting and Financial Reporting requires the disclosure of the Audit fee related to the Statutory

Audit. The expense for statutory audit included in the Other external services (including external audit fees) amounts to USD

87,997.

31. Impairment of financial assets, other than loans to customers

Movements in the allowance for impairment financial assets other than loan:

31 December 2022 31 December 2021

At 1 January 9,584,090 9,081,196

Impairment charge/(reversal) for the period 36,098,059 1,017,690

- on investment securities 36,219,706 853,544

- on placements 7,369 (36,120)

- on loans to banks 10,829 380,912

- on other assets (139,845) (180,646)

Translation difference 145,290 (514,796)

At the end of the period 45,827,439 9,584,090

32. Income tax

Income tax is comprised of:

Year ended Year ended

31 December 2022 31 December 2021

Current income tax 16,515,803 14,855,204

Deferred tax (income)/expense (note 20) (582,106) (108,132)

15,933,697 14,747,072