Page 143 - Annual Report 2022

P. 143

81 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

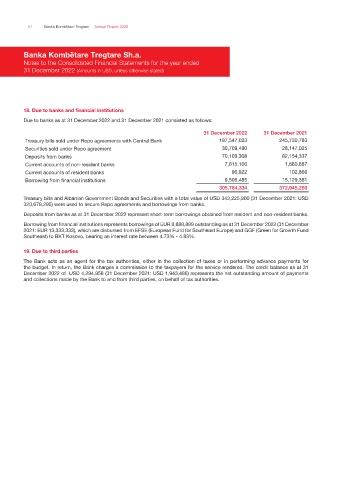

18. Due to banks and financial institutions

Due to banks as at 31 December 2022 and 31 December 2021 consisted as follows:

31 December 2022 31 December 2021

Treasury bills sold under Repo agreements with Central Bank 187,547,023 245,730,783

Securities sold under Repo agreement 30,709,490 28,147,025

Deposits from banks 70,109,308 82,154,337

Current accounts of non-resident banks 7,815,106 1,680,887

Current accounts of resident banks 96,922 102,866

Borrowing from financial institutions 9,506,485 15,129,361

305,784,334 372,945,259

Treasury bills and Albanian Government Bonds and Securities with a total value of USD 343,225,900 (31 December 2021: USD

320,678,295) were used to secure Repo agreements and borrowings from banks.

Deposits from banks as at 31 December 2022 represent short-term borrowings obtained from resident and non-resident banks.

Borrowing from financial institutions represents borrowings of EUR 8,888,889 outstanding as at 31 December 2022 (31 December

2021: EUR 13,333,333), which are disbursed from EFSE (European Fund for Southeast Europe) and GGF (Green for Growth Fund

Southeast) to BKT Kosovo, bearing an interest rate between 4.73% - 4.83%.

19. Due to third parties

The Bank acts as an agent for the tax authorities, either in the collection of taxes or in performing advance payments for

the budget. In return, the Bank charges a commission to the taxpayers for the service rendered. The credit balance as at 31

December 2022 of USD 4,294,958 (31 December 2021: USD 1,943,486) represents the net outstanding amount of payments

and collections made by the Bank to and from third parties, on behalf of tax authorities.