Page 144 - Annual Report 2022

P. 144

Banka Kombëtare Tregtare Annual Report 2022 82

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

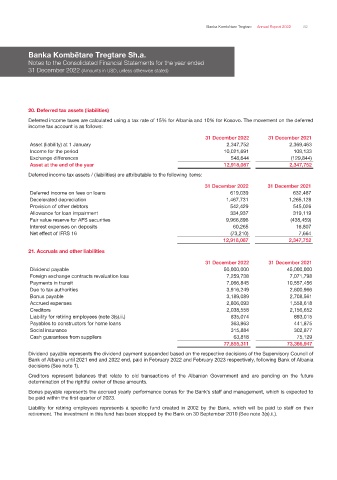

20. Deferred tax assets (liabilities)

Deferred income taxes are calculated using a tax rate of 15% for Albania and 10% for Kosovo. The movement on the deferred

income tax account is as follows:

31 December 2022 31 December 2021

Asset (liability) at 1 January 2,347,752 2,369,463

Income for the period 10,021,691 108,133

Exchange differences 548,644 (129,844)

Asset at the end of the year 12,918,087 2,347,752

Deferred income tax assets / (liabilities) are attributable to the following items:

31 December 2022 31 December 2021

Deferred income on fees on loans 619,039 632,467

Decelerated depreciation 1,467,731 1,265,128

Provision of other debtors 542,429 545,026

Allowance for loan impairment 334,937 319,119

Fair value reserve for AFS securities 9,966,896 (438,459)

Interest expenses on deposits 60,265 16,807

Net effect of IFRS 16 (73,210) 7,664

12,918,087 2,347,752

21. Accruals and other liabilities

31 December 2022 31 December 2021

Dividend payable 50,000,000 45,000,000

Foreign exchange contracts revaluation loss 7,259,738 7,071,798

Payments in transit 7,066,845 10,557,456

Due to tax authorities 3,916,249 2,600,966

Bonus payable 3,189,089 2,708,561

Accrued expenses 2,806,093 1,558,618

Creditors 2,038,558 2,156,652

Liability for retiring employees (note 3(s).ii.) 835,074 893,015

Payables to constructors for home loans 363,963 441,875

Social insurance 315,884 302,877

Cash guarantees from suppliers 63,818 75,129

77,855,311 73,366,947

Dividend payable represents the dividend payment suspended based on the respective decisions of the Supervisory Council of

Bank of Albania until 2021 end and 2022 end, paid in February 2022 and February 2023 respectively, following Bank of Albania

decisions (See note 1).

Creditors represent balances that relate to old transactions of the Albanian Government and are pending on the future

determination of the rightful owner of these amounts.

Bonus payable represents the accrued yearly performance bonus for the Bank’s staff and management, which is expected to

be paid within the first quarter of 2023.

Liability for retiring employees represents a specific fund created in 2002 by the Bank, which will be paid to staff on their

retirement. The investment in this fund has been stopped by the Bank on 30 September 2010 (See note 3(s).ii.).