Page 123 - BKT Annual Report 2023 EN

P. 123

ANNUAL REPORT 2023 54

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

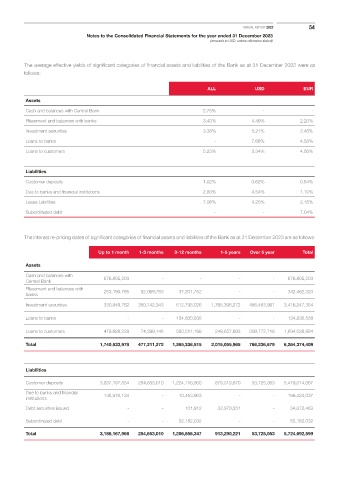

The average effective yields of significant categories of financial assets and liabilities of the Bank as at 31 December 2022 were as

follows:

ALL USD EUR

Assets

Cash and balances with Central Bank 2.75% - -

Placement and balances with banks 3.40% 4.49% 2.20%

Investment securities 3.38% 5.21% 3.46%

Loans to banks - 7.68% 4.58%

Loans to customers 5.25% 5.34% 4.66%

Liabilities

Customer deposits 1.02% 0.62% 0.64%

Due to banks and financial institutions 2.80% 4.54% 1.10%

Lease Labilities 7.06% 4.25% 2.16%

Subordinated debt - - 7.04%

The interest re-pricing dates of significant categories of financial assets and liabilities of the Bank as at 31 December 2023 are as follows:

Up to 1 month 1-3 months 3-12 months 1-5 years Over 5 year Total

Assets

Cash and balances with 676,805,203 - - - - 676,805,203

Central Bank

Placement and balances with 253,190,785 52,069,783 37,201,752 - - 342,462,320

banks

Investment securities 330,849,762 350,742,343 512,793,026 1,765,398,272 456,463,961 3,416,247,364

Loans to banks - - 134,830,538 - - 134,830,538

Loans to customers 479,688,228 74,399,146 580,511,199 249,657,693 309,772,718 1,694,028,984

Total 1,740,533,978 477,211,272 1,265,336,515 2,015,055,965 766,236,679 6,264,374,409

Liabilities

Customer deposits 3,037,197,834 284,653,010 1,224,118,500 879,319,670 53,725,053 5,479,014,067

Due to banks and financial 148,970,134 - 10,453,903 - - 159,424,037

institutions

Debt securities issued - - 101,912 33,970,551 - 34,072,463

Subordinated debt - - 52,182,032 - - 52,182,032

Total 3,186,167,968 284,653,010 1,286,856,347 913,290,221 53,725,053 5,724,692,599