Page 118 - BKT Annual Report 2023 EN

P. 118

49 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

Collateral held as security for financial assets other than loans and advances depends on the nature of the instrument. Debt securities,

treasury and other eligible bills are generally unsecured, with the exception of asset-backed securities and similar instruments, which

are secured by portfolios of financial instruments.

The Group’s policies regarding obtaining collateral have not significantly changed during the reporting period and there has been no

significant change in the overall quality of the collateral held by the Group since the prior period.

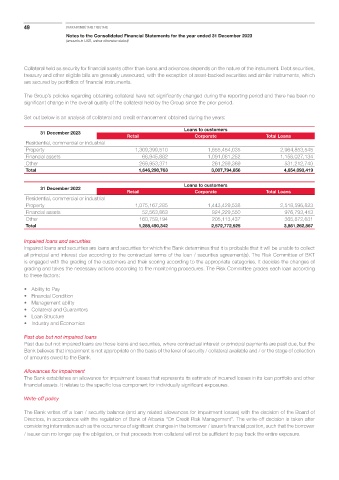

Set out below is an analysis of collateral and credit enhancement obtained during the years:

Loans to customers

31 December 2023

Retail Corporate Total Loans

Residential, commercial or industrial

Property 1,309,399,510 1,655,454,035 2,964,853,545

Financial assets 66,945,882 1,091,081,252 1,158,027,134

Other 269,953,371 261,259,369 531,212,740

Total 1,646,298,763 3,007,794,656 4,654,093,419

Loans to customers

31 December 2022

Retail Corporate Total Loans

Residential, commercial or industrial

Property 1,075,167,285 1,443,429,538 2,518,596,823

Financial assets 52,563,863 924,229,550 976,793,413

Other 160,759,194 205,113,437 365,872,631

Total 1,288,490,342 2,572,772,525 3,861,262,867

Impaired loans and securities

Impaired loans and securities are loans and securities for which the Bank determines that it is probable that it will be unable to collect

all principal and interest due according to the contractual terms of the loan / securities agreement(s). The Risk Committee of BKT

is engaged with the grading of the customers and their scoring according to the appropriate categories. It decides the changes of

grading and takes the necessary actions according to the monitoring procedures. The Risk Committee grades each loan according

to these factors:

• Ability to Pay

• Financial Condition

• Management ability

• Collateral and Guarantors

• Loan Structure

• Industry and Economics

Past due but not impaired loans

Past due but not impaired loans are those loans and securities, where contractual interest or principal payments are past due, but the

Bank believes that impairment is not appropriate on the basis of the level of security / collateral available and / or the stage of collection

of amounts owed to the Bank.

Allowances for impairment

The Bank establishes an allowance for impairment losses that represents its estimate of incurred losses in its loan portfolio and other

financial assets. It relates to the specific loss component for individually significant exposures.

Write-off policy

The Bank writes off a loan / security balance (and any related allowances for impairment losses) with the decision of the Board of

Directors, in accordance with the regulation of Bank of Albania “On Credit Risk Management”. The write-off decision is taken after

considering information such as the occurrence of significant changes in the borrower / issuer’s financial position, such that the borrower

/ issuer can no longer pay the obligation, or that proceeds from collateral will not be sufficient to pay back the entire exposure.