Page 122 - BKT Annual Report 2023 EN

P. 122

53 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

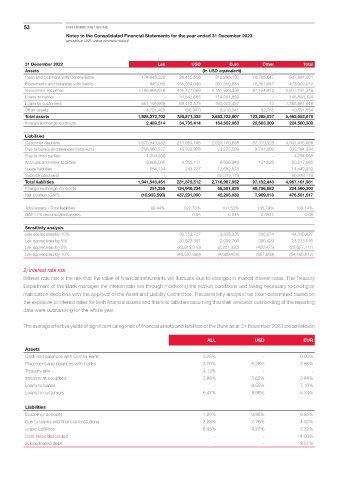

31 December 2022 Lek USD Euro Other Total

Assets (In USD equivalent)

Cash and balances with Central Bank 174,945,328 26,485,556 316,295,130 19,765,647 537,491,661

Placements and balances with banks 945,085 155,034,396 301,560,884 16,361,647 473,902,012

Investment securities 1,196,565,978 476,177,089 1,151,923,336 87,124,975 2,911,791,378

Loans to banks - 31,842,665 114,051,659 - 145,894,324

Loans to customers 551,195,906 69,412,573 763,073,457 13 1,383,681,949

Other assets 4,721,405 (80,947) 6,218,341 32,755 10,891,554

Total assets 1,928,373,702 758,871,332 2,653,122,807 123,285,037 5,463,652,878

Foreign exchange contracts 2,489,514 34,735,414 164,652,063 22,683,309 224,560,300

Liabilities

Customer deposits 1,670,949,482 210,063,198 2,623,103,658 87,319,528 4,591,435,866

Due to banks and financial institutions 256,060,877 16,705,976 23,275,589 9,741,892 305,784,334

Due to third parties 4,294,958 - - - 4,294,958

Accruals and other liabilities 9,686,000 4,363,111 6,636,948 131,026 20,817,085

Lease liabilities 554,134 243,227 13,652,578 - 14,449,939

Subordinated debt - - 50,319,179 - 50,319,179

Total liabilities 1,941,545,451 231,375,512 2,716,987,952 97,192,446 4,987,101,361

Foreign exchange contracts 251,355 124,940,234 58,581,829 40,786,882 224,560,300

Net position (GAP) (10,933,590) 437,291,000 42,205,089 7,989,018 476,551,517

Total assets / Total liabilities 99.44% 222.73% 101.52% 105.79% 109.14%

GAP / FX denominated assets 0.55 0.015 0.0547 0.08

Sensitivity analysis

Lek depreciates by 10% 39,753,727 3,836,826 726,274 44,316,827

Lek depreciates by 5% 20,823,381 2,009,766 380,429 23,213,576

Lek appreciates by 5% (23,015,316) (2,221,320) (420,475) (25,657,111)

Lek appreciates by 10% (48,587,889) (4,689,454) (887,669) (54,165,012)

2) Interest rate risk

Interest rate risk is the risk that the value of financial instruments will fluctuate due to changes in market interest rates. The Treasury

Department of the Bank manages the interest rate risk through monitoring the market conditions and taking necessary re-pricing or

reallocation decisions with the approval of the Asset and Liability Committee. The sensitivity analysis has been determined based on

the exposure to interest rates for both financial assets and financial liabilities assuming that their amounts outstanding at the reporting

date were outstanding for the whole year.

The average effective yields of significant categories of financial assets and liabilities of the Bank as at 31 December 2023 are as follows:

ALL USD EUR

Assets

Cash and balances with Central Bank 3.25% - 0.00%

Placement and balances with banks 3.70% 5.28% 3.86%

Treasury bills 4.12% - -

Investment securities 3.88% 5.62% 3.84%

Loans to banks - 8.55% 7.10%

Loans to customers 6.47% 8.98% 5.34%

Liabilities

Customer deposits 1.26% 0.93% 0.85%

Due to banks and financial institutions 3.28% 7.76% 4.07%

Lease Labilities 6.93% 4.27% 2.32%

Debt securities issued - - 4.00%

Subordinated debt - - 8.51%