Page 130 - BKT Annual Report 2023 EN

P. 130

61 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

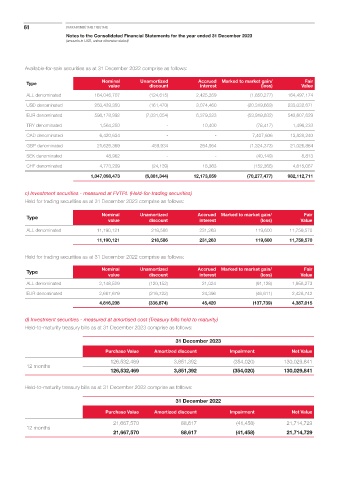

Available-for-sale securities as at 31 December 2022 comprise as follows:

Fair

Type Nominal Unamortized Accrued Marked to market gain/ Value

discount

interest

value

(loss)

ALL denominated 164,046,707 (124,615) 2,425,359 (1,850,277) 164,497,174

USD denominated 250,439,350 (161,470) 3,074,460 (20,319,669) 233,032,671

EUR denominated 598,178,992 (7,031,054) 6,379,523 (53,919,832) 543,607,629

TRY denominated 1,564,250 - 10,400 (78,417) 1,496,233

CAD denominated 6,420,634 - - 7,407,606 13,828,240

GBP denominated 21,626,369 459,934 264,954 (1,324,373) 21,026,884

SEK denominated 48,962 - - (40,149) 8,813

CHF denominated 4,773,209 (24,139) 18,363 (152,366) 4,615,067

1,047,098,473 (6,881,344) 12,173,059 (70,277,477) 982,112,711

c) Investment securities - measured at FVTPL (Held-for-trading securities)

Held for trading securities as at 31 December 2023 comprise as follows:

Nominal Unamortized Accrued Marked to market gain/ Fair

Type value discount interest (loss) Value

ALL denominated 11,190,121 218,586 231,263 119,600 11,759,570

11,190,121 218,586 231,263 119,600 11,759,570

Held for trading securities as at 31 December 2022 comprise as follows:

Type Nominal Unamortized Accrued Marked to market gain/ Fair

value discount interest (loss) Value

ALL denominated 2,148,529 (120,152) 21,024 (91,128) 1,958,273

EUR denominated 2,667,679 (216,722) 24,396 (46,611) 2,428,742

4,816,208 (336,874) 45,420 (137,739) 4,387,015

d) Investment securities - measured at amortised cost (Treasury bills held to maturity)

Held-to-maturity treasury bills as at 31 December 2023 comprise as follows:

31 December 2023

Purchase Value Amortized discount Impairment Net Value

126,532,469 3,851,392 (354,020) 130,029,841

12 months

126,532,469 3,851,392 (354,020) 130,029,841

Held-to-maturity treasury bills as at 31 December 2022 comprise as follows:

31 December 2022

Purchase Value Amortized discount Impairment Net Value

21,667,570 88,617 (41,458) 21,714,729

12 months

21,667,570 88,617 (41,458) 21,714,729