Page 135 - BKT Annual Report 2023 EN

P. 135

ANNUAL REPORT 2023 66

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

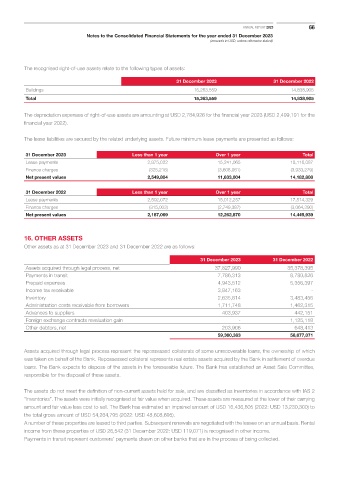

The recognised right-of-use assets relate to the following types of assets:

31 December 2023 31 December 2022

Buildings 15,263,559 14,838,905

Total 15,263,559 14,838,905

The depreciation expenses of right-of-use assets are amounting at USD 2,784,926 for the financial year 2023 (USD 2,499,191 for the

financial year 2022).

The lease liabilities are secured by the related underlying assets. Future minimum lease payments are presented as follows:

31 December 2023 Less than 1 year Over 1 year Total

Lease payments 2,875,022 15,241,065 18,116,087

Finance charges (325,218) (3,608,061) (3,933,279)

Net present values 2,549,804 11,633,004 14,182,808

31 December 2022 Less than 1 year Over 1 year Total

Lease payments 2,502,072 15,012,257 17,514,329

Finance charges (315,003) (2,749,387) (3,064,390)

Net present values 2,187,069 12,262,870 14,449,939

16. OTHER ASSETS

Other assets as at 31 December 2023 and 31 December 2022 are as follows:

31 December 2023 31 December 2022

Assets acquired through legal process, net 37,827,990 35,378,395

Payments in transit 7,786,313 8,780,826

Prepaid expenses 4,943,512 5,356,397

Income tax receivable 3,847,163 -

Inventory 2,635,814 3,483,456

Administration costs receivable from borrowers 1,711,748 1,462,315

Advances to suppliers 403,937 442,151

Foreign exchange contracts revaluation gain - 1,125,118

Other debtors, net 203,906 648,413

59,360,383 56,677,071

Assets acquired through legal process represent the repossessed collaterals of some unrecoverable loans, the ownership of which

was taken on behalf of the Bank. Repossessed collateral represents real estate assets acquired by the Bank in settlement of overdue

loans. The Bank expects to dispose of the assets in the foreseeable future. The Bank has established an Asset Sale Committee,

responsible for the disposal of these assets.

The assets do not meet the definition of non-current assets held for sale, and are classified as inventories in accordance with IAS 2

“Inventories”. The assets were initially recognised at fair value when acquired. These assets are measured at the lower of their carrying

amount and fair value less cost to sell. The Bank has estimated an impaired amount of USD 16,436,805 (2022: USD 13,230,300) to

the total gross amount of USD 54,264,795 (2022: USD 48,608,695).

A number of these properties are leased to third parties. Subsequent renewals are negotiated with the lessee on an annual basis. Rental

income from these properties of USD 26,542 (31 December 2022: USD 119,071) is recognised in other income.

Payments in transit represent customers’ payments drawn on other banks that are in the process of being collected.