Page 133 - BKT Annual Report 2023 EN

P. 133

ANNUAL REPORT 2023 64

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

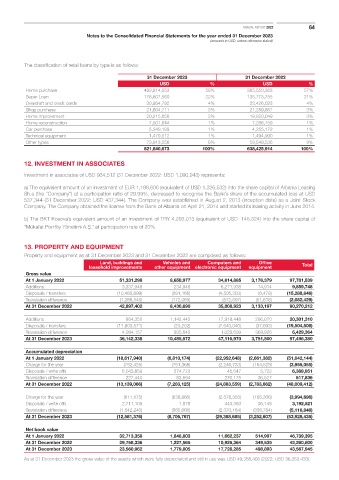

The classification of retail loans by type is as follows:

31 December 2023 31 December 2022

USD % USD %

Home purchase 483,814,053 58% 365,550,363 57%

Super Loan 176,807,560 22% 135,773,755 21%

Overdraft and credit cards 30,954,792 4% 23,426,023 4%

Shop purchase 21,604,711 3% 21,289,867 3%

Home improvement 20,215,656 2% 19,820,049 3%

Home reconstruction 7,501,644 1% 7,266,159 1%

Car purchase 5,549,189 1% 4,255,172 1%

Technical equipment 1,479,512 1% 1,494,990 1%

Other types 73,913,556 8% 59,549,536 9%

821,840,673 100% 638,425,914 100%

12. INVESTMENT IN ASSOCIATES

Investment in associates of USD 934,512 (31 December 2022: USD 1,090,943) represents:

a) The equivalent amount of an investment of EUR 1,199,600 (equivalent of USD 1,326,532) into the share capital of Albania Leasing

Sh.a (the “Company”) at a participation ratio of 29.99%, decreased to recognise the Bank’s share of the accumulated loss at USD

537,344 (31 December 2022: USD 437,344). The Company was established in August 2, 2013 (inception date) as a Joint Stock

Company. The Company obtained the license from the Bank of Albania on April 21, 2014 and started its leasing activity in June 2014.

b) The BKT Kosova’s equivalent amount of an investment of TRY 4,293,013 (equivalent of USD 145,324) into the share capital of

“Mükafat Portföy Yönetimi A.Ş.” at participation rate of 20%.

13. PROPERTY AND EQUIPMENT

Property and equipment as at 31 December 2023 and 31 December 2022 are composed as follows:

Land, buildings and Vehicles and Computers and Office

leasehold improvements other equipment electronic equipment equipment Total

Gross value

At 1 January 2022 51,331,298 8,658,977 34,614,885 3,176,379 97,781,539

Additions 3,337,948 234,948 6,271,938 14,914 9,859,748

Disposals / transfers (10,485,699) (291,166) (4,505,303) (6,478) (15,288,646)

Translation difference (1,286,145) (172,069) (572,597) (51,618) (2,082,429)

At 31 December 2022 42,897,402 8,430,690 35,808,923 3,133,197 90,270,212

Additions 954,350 1,142,442 17,918,448 286,070 20,301,310

Disposals / transfers (11,803,571) (23,202) (7,640,040) (37,693) (19,504,506)

Translation difference 4,094,157 935,642 1,029,639 369,926 6,429,364

At 31 December 2023 36,142,338 10,485,572 47,116,970 3,751,500 97,496,380

Accumulated depreciation

At 1 January 2022 (18,617,940) (6,810,174) (22,952,648) (2,661,382) (51,042,144)

Charge for the year (792,425) (751,368) (2,246,733) (164,529) (3,955,055)

Disposals / write offs 6,043,859 274,723 45,647 5,722 6,369,951

Translation difference 227,440 83,694 270,175 36,527 617,836

At 31 December 2022 (13,139,066) (7,203,125) (24,883,559) (2,783,662) (48,009,412)

Charge for the year (611,175) (638,860) (2,578,355) (166,306) (3,994,696)

Disposals / write offs 2,711,105 1,878 443,393 36,145 3,192,521

Translation difference (1,542,240) (865,660) (2,370,164) (338,784) (5,116,848)

At 31 December 2023 (12,581,376) (8,705,767) (29,388,685) (3,252,607) (53,928,435)

Net book value

At 1 January 2022 32,713,358 1,848,803 11,662,237 514,997 46,739,395

At 31 December 2022 29,758,336 1,227,565 10,925,364 349,535 42,260,800

At 31 December 2023 23,560,962 1,779,805 17,728,285 498,893 43,567,945

As at 31 December 2023 the gross value of the assets which were fully depreciated and still in use was USD 49,368,405 (2022: USD 36,353,433).