Page 108 - Annual Report 2022

P. 108

Banka Kombëtare Tregtare Annual Report 2022 46

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

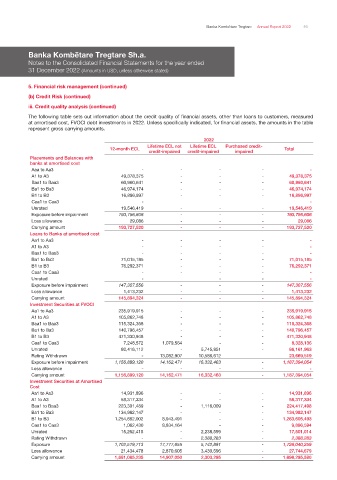

5. Financial risk management (continued)

(b) Credit Risk (continued)

iii. Credit quality analysis (continued)

The following table sets out information about the credit quality of financial assets, other than loans to customers, measured

at amortised cost, FVOCI debt investments in 2022. Unless specifically indicated, for financial assets, the amounts in the table

represent gross carrying amounts.

2022

Lifetime ECL not Lifetime ECL Purchased credit-

12-month ECL Total

credit-impaired credit-impaired impaired

Placements and Balances with

banks at amortised cost

Aaa to Aa3 - - - - -

A1 to A3 49,378,375 - - - 49,378,375

Baa1 to Baa3 60,960,641 - - - 60,960,641

Ba1 to Ba3 46,974,174 - - - 46,974,174

B1 to B3 16,896,997 - - - 16,896,997

Caa1 to Caa3 - -

Unrated 19,546,419 - - - 19,546,419

Exposure before impairment 193,756,606 - - - 193,756,606

Loss allowance 29,086 - - - 29,086

Carrying amount 193,727,520 - - - 193,727,520

Loans to Banks at amortised cost

Aa1 to Aa3 - - - - -

A1 to A3 - - - - -

Baa1 to Baa3 - - - - -

Ba1 to Ba3 71,015,185 - - - 71,015,185

B1 to B3 76,292,371 - - - 76,292,371

Caa1 to Caa3 - - - - -

Unrated - - - -

Exposure before impairment 147,307,556 - - - 147,307,556

Loss allowance 1,413,232 - - - 1,413,232

Carrying amount 145,894,324 - - - 145,894,324

Investment Securities at FVOCI

Aa1 to Aa3 235,919,915 - - - 235,919,915

A1 to A3 105,862,748 - - - 105,862,748

Baa1 to Baa3 115,324,368 - - - 115,324,368

Ba1 to Ba3 140,796,457 - - - 140,796,457

B1 to B3 471,330,948 - - - 471,330,948

Caa1 to Caa3 7,248,572 1,079,564 - - 8,328,136

Unrated 80,416,112 - 5,745,851 - 86,161,963

Rating Withdrawn - 13,082,907 10,586,612 23,669,519

Exposure before impairment 1,156,899,120 14,162,471 16,332,463 - 1,187,394,054

Loss allowance - - - - -

Carrying amount 1,156,899,120 14,162,471 16,332,463 - 1,187,394,054

Investment Securities at Amortised

Cost

Aa1 to Aa3 14,931,896 - - - 14,931,896

A1 to A3 58,317,334 - - - 58,317,334

Baa1 to Baa3 223,301,489 - 1,116,009 - 224,417,498

Ba1 to Ba3 134,982,147 - - - 134,982,147

B1 to B3 1,254,662,002 8,943,491 - - 1,263,605,493

Caa1 to Caa3 1,062,430 8,834,164 - - 9,896,594

Unrated 15,262,415 - 2,238,599 - 17,501,014

Rating Withdrawn - - 2,388,283 - 2,388,283

Exposure 1,702,519,713 17,777,655 5,742,891 - 1,726,040,259

Loss allowance 21,434,478 2,870,605 3,439,596 - 27,744,679

Carrying amount 1,681,085,235 14,907,050 2,303,295 - 1,698,295,580