Page 116 - Annual Report 2022

P. 116

Banka Kombëtare Tregtare Annual Report 2022 54

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

iv. Collateral and other credit enhancements

The Group employs a range of policies and practices to mitigate credit risk. The most common of these is accepting collateral

for funds advanced. The Group has internal policies on the acceptability of specific classes of collateral or credit risk mitigation.

The Group prepares a valuation of the collateral obtained as part of the loan origination process. This assessment is reviewed

periodically.

The Group prepares a valuation of the collateral obtained as part of the loan origination process. This assessment is reviewed

periodically. The principal collateral types for loans and advances are:

– Mortgages over residential properties;

– Financial Assets

– Charges over business assets such as premises, machineries, and accounts receivable;

Longer-term finance and lending to corporate entities are generally secured; revolving individual credit facilities are generally

unsecured.

Collateral held as security for financial assets other than loans and advances depends on the nature of the instrument. Debt

securities, treasury and other eligible bills are generally unsecured, with the exception of asset-backed securities and similar

instruments, which are secured by portfolios of financial instruments.

The Group’s policies regarding obtaining collateral have not significantly changed during the reporting period and there has been

no significant change in the overall quality of the collateral held by the Group since the prior period.

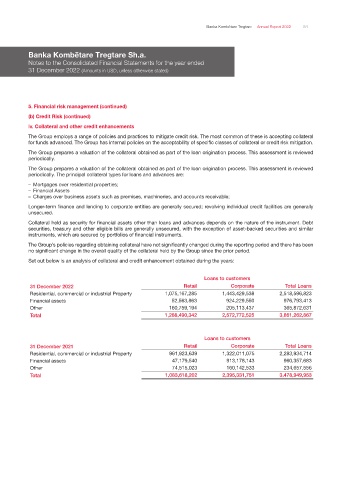

Set out below is an analysis of collateral and credit enhancement obtained during the years:

Loans to customers

31 December 2022 Retail Corporate Total Loans

Residential, commercial or industrial Property 1,075,167,285 1,443,429,538 2,518,596,823

Financial assets 52,563,863 924,229,550 976,793,413

Other 160,759,194 205,113,437 365,872,631

Total 1,288,490,342 2,572,772,525 3,861,262,867

Loans to customers

31 December 2021 Retail Corporate Total Loans

Residential, commercial or industrial Property 961,923,639 1,322,011,075 2,283,934,714

Financial assets 47,179,540 913,178,143 960,357,683

Other 74,515,023 160,142,533 234,657,556

Total 1,083,618,202 2,395,331,751 3,478,949,953