Page 115 - Annual Report 2022

P. 115

53 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

iii. Credit quality analysis (continued)

Loans with renegotiated terms

Loans with renegotiated terms are loans that have been restructured due to deterioration in the borrower’s financial position and

where the Bank has made concessions that it would not otherwise consider.

Once the loan is restructured, its performance is closely monitored for the purpose of impairment testing.

Set out below are the carrying amounts of loans to customers whose term have been renegotiated and are under monitoring:

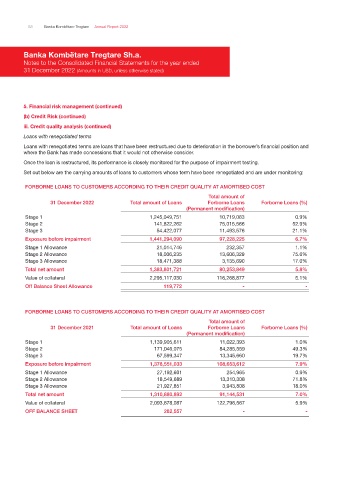

FORBORNE LOANS TO CUSTOMERS ACCORDING TO THEIR CREDIT QUALITY AT AMORTISED COST

Total amount of

31 December 2022 Total amount of Loans Forborne Loans Forborne Loans (%)

(Permanent modification)

Stage 1 1,245,049,751 10,719,083 0.9%

Stage 2 141,822,262 75,015,566 52.9%

Stage 3 54,422,077 11,493,576 21.1%

Exposure before impairment 1,441,294,090 97,228,225 6.7%

Stage 1 Allowance 21,014,746 232,357 1.1%

Stage 2 Allowance 18,006,235 13,606,329 75.6%

Stage 3 Allowance 18,471,388 3,135,690 17.0%

Total net amount 1,383,801,721 80,253,849 5.8%

Value of collateral 2,295,117,030 116,268,877 5.1%

Off Balance Sheet Allowance 119,772 - -

FORBORNE LOANS TO CUSTOMERS ACCORDING TO THEIR CREDIT QUALITY AT AMORTISED COST

Total amount of

31 December 2021 Total amount of Loans Forborne Loans Forborne Loans (%)

(Permanent modification)

Stage 1 1,139,905,611 11,022,393 1.0%

Stage 2 171,046,075 84,285,559 49.3%

Stage 3 67,599,347 13,345,660 19.7%

Exposure before impairment 1,378,551,033 108,653,612 7.9%

Stage 1 Allowance 27,192,601 254,965 0.9%

Stage 2 Allowance 18,549,689 13,310,308 71.8%

Stage 3 Allowance 21,927,851 3,943,808 18.0%

Total net amount 1,310,880,892 91,144,531 7.0%

Value of collateral 2,093,678,087 122,796,567 5.9%

OFF BALANCE SHEET 282,557 - -