Page 112 - Annual Report 2022

P. 112

Banka Kombëtare Tregtare Annual Report 2022 50

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

iii. Credit quality analysis (continued)

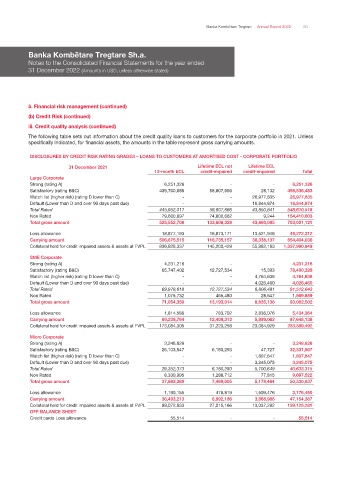

The following table sets out information about the credit quality loans to customers for the corporate portfolio in 2021. Unless

specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts.

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST - CORPORATE PORTFOLIO

31 December 2021 Lifetime ECL not Lifetime ECL

12-month ECL credit-impaired credit-impaired Total

Large Corporate

Strong (rating A) 6,251,326 - - 6,251,326

Satisfactory (rating B&C) 439,700,685 58,807,666 28,132 498,536,483

Watch list (higher risk) (rating D lower than C) - - 26,977,835 26,977,835

Default (Lower than D and over 90 days past due) - - 16,844,874 16,844,874

Total Rated 445,952,011 58,807,666 43,850,841 548,610,518

Non Rated 79,600,697 74,800,662 9,244 154,410,603

Total gross amount 525,552,708 133,608,328 43,860,085 703,021,121

Loss allowance 18,877,193 16,873,171 13,521,948 49,272,312

Carrying amount 506,675,515 116,735,157 30,338,137 654,404,036

Collateral held for credit impaired assets & assets at FVPL 836,828,337 145,200,429 55,962,183 1,037,990,949

SME Corporate

Strong (rating A) 4,231,216 - - 4,231,216

Satisfactory (rating B&C) 65,747,402 12,727,534 15,393 78,490,329

Watch list (higher risk) (rating D lower than C) - - 4,764,638 4,764,638

Default (Lower than D and over 90 days past due) - - 4,026,460 4,026,460

Total Rated 69,978,618 12,727,534 8,806,491 91,512,643

Non Rated 1,075,732 465,480 28,647 1,569,859

Total gross amount 71,054,350 13,193,014 8,835,138 93,082,502

Loss allowance 1,814,586 783,702 2,836,076 5,434,364

Carrying amount 69,239,764 12,409,312 5,999,062 87,648,138

Collateral held for credit impaired assets & assets at FVPL 173,084,305 37,220,258 23,084,929 233,389,492

Micro Corporate

Strong (rating A) 3,248,826 - - 3,248,826

Satisfactory (rating B&C) 26,103,547 6,180,293 47,727 32,331,567

Watch list (higher risk) (rating D lower than C) - - 1,807,847 1,807,847

Default (Lower than D and over 90 days past due) - - 3,245,075 3,245,075

Total Rated 29,352,373 6,180,293 5,100,649 40,633,315

Non Rated 8,330,995 1,288,712 77,815 9,697,522

Total gross amount 37,683,368 7,469,005 5,178,464 50,330,837

Loss allowance 1,190,155 476,819 1,509,476 3,176,450

Carrying amount 36,493,213 6,992,186 3,668,988 47,154,387

Collateral held for credit impaired assets & assets at FVPL 99,072,833 27,015,166 13,037,282 139,125,281

OFF BALANCE SHEET

Credit cards Loss allowance 55,514 - - 55,514