Page 114 - Annual Report 2022

P. 114

Banka Kombëtare Tregtare Annual Report 2022 52

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

5. Financial risk management (continued)

(b) Credit Risk (continued)

iii. Credit quality analysis (continued)

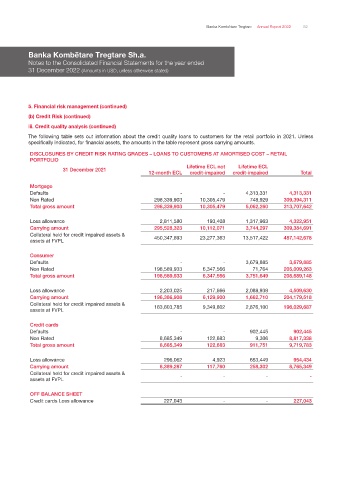

The following table sets out information about the credit quality loans to customers for the retail portfolio in 2021. Unless

specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts.

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST – RETAIL

PORTFOLIO

Lifetime ECL not Lifetime ECL

31 December 2021

12-month ECL credit-impaired credit-impaired Total

Mortgage

Defaults - - 4,313,331 4,313,331

Non Rated 298,339,903 10,305,479 748,929 309,394,311

Total gross amount 298,339,903 10,305,479 5,062,260 313,707,642

Loss allowance 2,811,580 193,408 1,317,963 4,322,951

Carrying amount 295,528,323 10,112,071 3,744,297 309,384,691

Collateral held for credit impaired assets &

assets at FVPL 450,347,893 23,277,363 13,517,422 487,142,678

Consumer

Defaults - - 3,679,885 3,679,885

Non Rated 198,589,933 6,347,566 71,764 205,009,263

Total gross amount 198,589,933 6,347,566 3,751,649 208,689,148

Loss allowance 2,203,025 217,666 2,088,939 4,509,630

Carrying amount 196,386,908 6,129,900 1,662,710 204,179,518

Collateral held for credit impaired assets &

assets at FVPL 183,803,785 9,349,802 2,876,100 196,029,687

Credit cards

Defaults - - 902,445 902,445

Non Rated 8,685,349 122,683 9,306 8,817,338

Total gross amount 8,685,349 122,683 911,751 9,719,783

Loss allowance 296,062 4,923 653,449 954,434

Carrying amount 8,389,287 117,760 258,302 8,765,349

Collateral held for credit impaired assets &

assets at FVPL - - - -

OFF BALANCE SHEET

Credit cards Loss allowance 227,043 - - 227,043