Page 139 - Annual Report 2022

P. 139

77 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

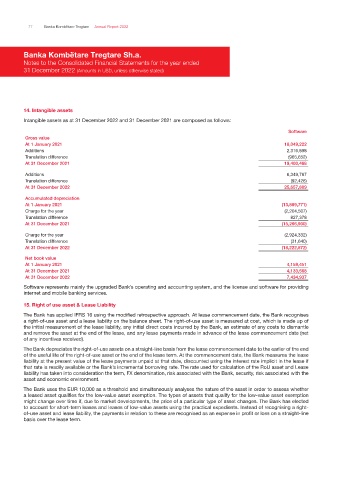

14. Intangible assets

Intangible assets as at 31 December 2022 and 31 December 2021 are composed as follows:

Software

Gross value

At 1 January 2021 18,049,222

Additions 2,316,898

Translation difference (965,652)

At 31 December 2021 19,400,468

Additions 6,349,767

Translation difference (92,426)

At 31 December 2022 25,657,809

Accumulated depreciation

At 1 January 2021 (13,889,771)

Charge for the year (2,204,507)

Translation difference 827,378

At 31 December 2021 (15,266,900)

Charge for the year (2,924,332)

Translation difference (31,640)

At 31 December 2022 (18,222,872)

Net book value

At 1 January 2021 4,159,451

At 31 December 2021 4,133,568

At 31 December 2022 7,434,937

Software represents mainly the upgraded Bank’s operating and accounting system, and the license and software for providing

internet and mobile banking services.

15. Right of use asset & Lease Liability

The Bank has applied IFRS 16 using the modified retrospective approach. At lease commencement date, the Bank recognises

a right-of-use asset and a lease liability on the balance sheet. The right-of-use asset is measured at cost, which is made up of

the initial measurement of the lease liability, any initial direct costs incurred by the Bank, an estimate of any costs to dismantle

and remove the asset at the end of the lease, and any lease payments made in advance of the lease commencement date (net

of any incentives received).

The Bank depreciates the right-of-use assets on a straight-line basis from the lease commencement date to the earlier of the end

of the useful life of the right-of-use asset or the end of the lease term. At the commencement date, the Bank measures the lease

liability at the present value of the lease payments unpaid at that date, discounted using the interest rate implicit in the lease if

that rate is readily available or the Bank’s incremental borrowing rate. The rate used for calculation of the RoU asset and Lease

liability has taken into consideration the term, FX denomination, risk associated with the Bank, security, risk associated with the

asset and economic environment.

The Bank uses the EUR 10,000 as a threshold and simultaneously analyses the nature of the asset in order to assess whether

a leased asset qualifies for the low-value asset exemption. The types of assets that qualify for the low-value asset exemption

might change over time if, due to market developments, the price of a particular type of asset changes. The Bank has elected

to account for short-term leases and leases of low-value assets using the practical expedients. Instead of recognising a right-

of-use asset and lease liability, the payments in relation to these are recognised as an expense in profit or loss on a straight-line

basis over the lease term.