Page 114 - BKT Annual Report 2023 EN

P. 114

45 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

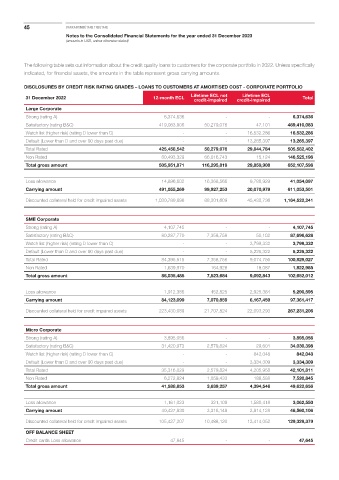

The following table sets out information about the credit quality loans to customers for the corporate portfolio in 2022. Unless specifically

indicated, for financial assets, the amounts in the table represent gross carrying amounts.

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST - CORPORATE PORTFOLIO

Lifetime ECL

31 December 2022 12-month ECL Lifetime ECL not credit-impaired Total

credit-impaired

Large Corporate

Strong (rating A) 6,374,636 - - 6,374,636

Satisfactory (rating B&C) 419,083,906 50,279,076 47,101 469,410,083

Watch list (higher risk) (rating D lower than C) - - 16,532,286 16,532,286

Default (Lower than D and over 90 days past due) - - 13,265,397 13,265,397

Total Rated 425,458,542 50,279,076 29,844,784 505,582,402

Non Rated 80,493,329 66,016,743 15,124 146,525,196

Total gross amount 505,951,871 116,295,819 29,859,908 652,107,598

Loss allowance 14,896,602 16,368,566 9,788,929 41,054,097

Carrying amount 491,055,269 99,927,253 20,070,979 611,053,501

Discounted collateral held for credit impaired assets 1,030,789,896 88,301,609 45,430,736 1,164,522,241

SME Corporate

Strong (rating A) 4,107,745 - - 4,107,745

Satisfactory (rating B&C) 80,287,770 7,358,756 50,102 87,696,628

Watch list (higher risk) (rating D lower than C) - - 3,799,332 3,799,332

Default (Lower than D and over 90 days past due) - - 5,225,322 5,225,322

Total Rated 84,395,515 7,358,756 9,074,756 100,829,027

Non Rated 1,639,970 164,928 18,087 1,822,985

Total gross amount 86,035,485 7,523,684 9,092,843 102,652,012

Loss allowance 1,912,386 452,825 2,925,384 5,290,595

Carrying amount 84,123,099 7,070,859 6,167,459 97,361,417

Discounted collateral held for credit impaired assets 223,430,089 21,707,824 22,093,293 267,231,206

Micro Corporate

Strong (rating A) 3,895,056 - - 3,895,056

Satisfactory (rating B&C) 31,420,973 2,579,824 29,601 34,030,398

Watch list (higher risk) (rating D lower than C) - - 842,048 842,048

Default (Lower than D and over 90 days past due) - - 3,334,309 3,334,309

Total Rated 35,316,029 2,579,824 4,205,958 42,101,811

Non Rated 6,272,824 1,059,433 188,588 7,520,845

Total gross amount 41,588,853 3,639,257 4,394,546 49,622,656

Loss allowance 1,161,023 321,109 1,580,418 3,062,550

Carrying amount 40,427,830 3,318,148 2,814,128 46,560,106

Discounted collateral held for credit impaired assets 105,427,207 10,488,120 13,414,052 129,329,379

OFF BALANCE SHEET

Credit cards Loss allowance 47,645 - - 47,645