Page 115 - BKT Annual Report 2023 EN

P. 115

ANNUAL REPORT 2023 46

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

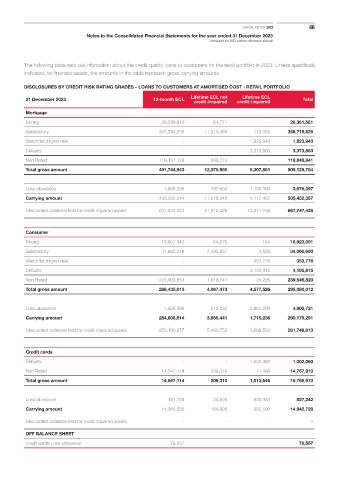

The following table sets out information about the credit quality loans to customers for the retail portfolio in 2023. Unless specifically

indicated, for financial assets, the amounts in the table represent gross carrying amounts.

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST - RETAIL PORTFOLIO

Lifetime ECL

31 December 2023 12-month ECL Lifetime ECL not credit-impaired Total

credit-impaired

Mortgage

Strong 26,299,810 61,771 - 26,361,581

Satisfactory 347,294,005 11,315,466 110,355 358,719,826

Watch list (higher risk) - - 1,823,943 1,823,943

Defaults - - 3,373,563 3,373,563

Non Rated 118,151,128 698,713 - 118,849,841

Total gross amount 491,744,943 12,075,950 5,307,861 509,128,754

Loss allowance 1,688,399 797,604 1,190,394 3,676,397

Carrying amount 490,056,544 11,278,346 4,117,467 505,452,357

Discounted collateral held for credit impaired assets 631,523,243 21,912,426 14,311,759 667,747,428

Consumer

Strong 16,867,942 54,875 184 16,923,001

Satisfactory 31,663,218 2,393,857 3,525 34,060,600

Watch list (higher risk) - - 353,776 353,776

Defaults - - 4,195,815 4,195,815

Non Rated 237,903,853 1,618,741 24,226 239,546,820

Total gross amount 286,435,013 4,067,473 4,577,526 295,080,012

Loss allowance 1,826,399 212,032 2,862,290 4,900,721

Carrying amount 284,608,614 3,855,441 1,715,236 290,179,291

Discounted collateral held for credit impaired assets 253,190,277 5,490,753 3,068,583 261,749,613

Credit cards

Defaults - - 1,002,060 1,002,060

Non Rated 14,547,114 209,310 11,486 14,767,910

Total gross amount 14,547,114 209,310 1,013,546 15,769,970

Loss allowance 181,784 24,505 620,953 827,242

Carrying amount 14,365,330 184,805 392,593 14,942,728

Discounted collateral held for credit impaired assets - - - -

OFF BALANCE SHEET

Credit cards Loss allowance 78,557 78,557