Page 116 - BKT Annual Report 2023 EN

P. 116

47 BANKA KOMBËTARE TREGTARE

Notes to the Consolidated Financial Statements for the year ended 31 December 2023

(amounts in USD, unless otherwise stated)

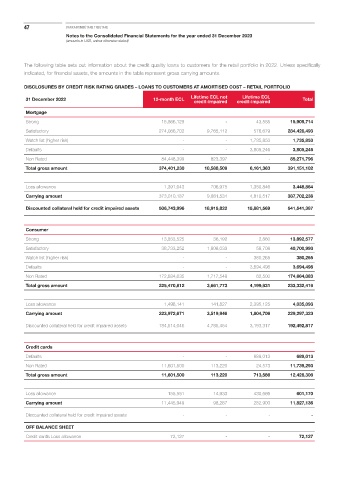

The following table sets out information about the credit quality loans to customers for the retail portfolio in 2022. Unless specifically

indicated, for financial assets, the amounts in the table represent gross carrying amounts.

DISCLOSURES BY CREDIT RISK RATING GRADES – LOANS TO CUSTOMERS AT AMORTISED COST – RETAIL PORTFOLIO

Lifetime ECL

31 December 2022 12-month ECL Lifetime ECL not credit-impaired Total

credit-impaired

Mortgage

Strong 15,866,129 - 43,585 15,909,714

Satisfactory 274,086,702 9,765,112 576,679 284,428,493

Watch list (higher risk) - - 1,735,853 1,735,853

Defaults - - 3,805,246 3,805,246

Non Rated 84,448,399 823,397 - 85,271,796

Total gross amount 374,401,230 10,588,509 6,161,363 391,151,102

Loss allowance 1,391,043 706,975 1,350,846 3,448,864

Carrying amount 373,010,187 9,881,534 4,810,517 387,702,238

Discounted collateral held for credit impaired assets 506,743,996 18,915,822 15,881,569 541,541,387

Consumer

Strong 13,853,525 36,192 2,860 13,892,577

Satisfactory 38,733,252 1,908,033 59,708 40,700,993

Watch list (higher risk) - - 380,265 380,265

Defaults - - 3,694,498 3,694,498

Non Rated 172,884,035 1,717,548 62,500 174,664,083

Total gross amount 225,470,812 3,661,773 4,199,831 233,332,416

Loss allowance 1,498,141 141,827 2,395,125 4,035,093

Carrying amount 223,972,671 3,519,946 1,804,706 229,297,323

Discounted collateral held for credit impaired assets 184,514,046 4,785,454 3,193,317 192,492,817

Credit cards

Defaults - - 689,013 689,013

Non Rated 11,601,500 113,220 24,573 11,739,293

Total gross amount 11,601,500 113,220 713,586 12,428,306

Loss allowance 155,551 14,933 430,686 601,170

Carrying amount 11,445,949 98,287 282,900 11,827,136

Discounted collateral held for credit impaired assets - - - -

OFF BALANCE SHEET

Credit cards Loss allowance 72,127 - - 72,127