Page 133 - Annual Report 2022

P. 133

71 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

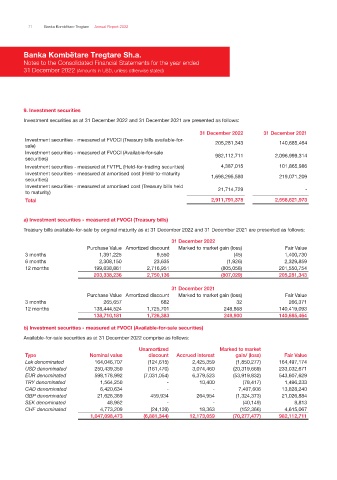

9. Investment securities

Investment securities as at 31 December 2022 and 31 December 2021 are presented as follows:

31 December 2022 31 December 2021

Investment securities - measured at FVOCI (Treasury bills available-for- 205,281,343 140,685,464

sale)

Investment securities - measured at FVOCI (Available-for-sale 982,112,711 2,096,999,314

securities)

Investment securities - measured at FVTPL (Held-for-trading securities) 4,387,015 101,865,986

Investment securities - measured at amortised cost (Held-to-maturity 1,698,295,580 219,071,209

securities)

Investment securities - measured at amortised cost (Treasury bills held 21,714,729 -

to maturity)

Total 2,911,791,378 2,558,621,973

a) Investment securities - measured at FVOCI (Treasury bills)

Treasury bills available-for-sale by original maturity as at 31 December 2022 and 31 December 2021 are presented as follows:

31 December 2022

Purchase Value Amortized discount Marked to market gain (loss) Fair Value

3 months 1,391,225 9,550 (45) 1,400,730

6 months 2,308,150 23,635 (1,926) 2,329,859

12 months 199,638,861 2,716,951 (805,058) 201,550,754

203,338,236 2,750,136 (807,029) 205,281,343

31 December 2021

Purchase Value Amortized discount Marked to market gain (loss) Fair Value

3 months 265,657 682 32 266,371

12 months 138,444,524 1,725,701 248,868 140,419,093

138,710,181 1,726,383 248,900 140,685,464

b) Investment securities - measured at FVOCI (Available-for-sale securities)

Available-for-sale securities as at 31 December 2022 comprise as follows:

Unamortized Marked to market

Type Nominal value discount Accrued interest gain/ (loss) Fair Value

Lek denominated 164,046,707 (124,615) 2,425,359 (1,850,277) 164,497,174

USD denominated 250,439,350 (161,470) 3,074,460 (20,319,669) 233,032,671

EUR denominated 598,178,992 (7,031,054) 6,379,523 (53,919,832) 543,607,629

TRY denominated 1,564,250 - 10,400 (78,417) 1,496,233

CAD denominated 6,420,634 - - 7,407,606 13,828,240

GBP denominated 21,626,369 459,934 264,954 (1,324,373) 21,026,884

SEK denominated 48,962 - - (40,149) 8,813

CHF denominated 4,773,209 (24,139) 18,363 (152,366) 4,615,067

1,047,098,473 (6,881,344) 12,173,059 (70,277,477) 982,112,711