Page 137 - Annual Report 2022

P. 137

75 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

11. Loans to customers (continued)

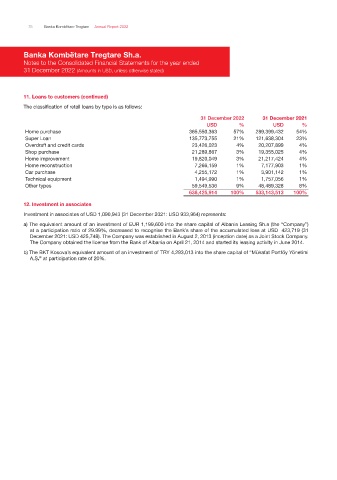

The classification of retail loans by type is as follows:

31 December 2022 31 December 2021

USD % USD %

Home purchase 365,550,363 57% 289,399,432 54%

Super Loan 135,773,755 21% 121,638,304 23%

Overdraft and credit cards 23,426,023 4% 20,207,899 4%

Shop purchase 21,289,867 3% 19,355,025 4%

Home improvement 19,820,049 3% 21,217,424 4%

Home reconstruction 7,266,159 1% 7,177,903 1%

Car purchase 4,255,172 1% 3,901,142 1%

Technical equipment 1,494,990 1% 1,757,056 1%

Other types 59,549,536 9% 48,489,328 8%

638,425,914 100% 533,143,513 100%

12. Investment in associates

Investment in associates of USD 1,090,943 (31 December 2021: USD 933,964) represents:

a) The equivalent amount of an investment of EUR 1,199,600 into the share capital of Albania Leasing Sh.a (the “Company”)

at a participation ratio of 29.99%, decreased to recognise the Bank’s share of the accumulated loss at USD 423,719 (31

December 2021: USD 425,748). The Company was established in August 2, 2013 (inception date) as a Joint Stock Company.

The Company obtained the license from the Bank of Albania on April 21, 2014 and started its leasing activity in June 2014.

b) The BKT Kosova’s equivalent amount of an investment of TRY 4,293,013 into the share capital of “Mükafat Portföy Yönetimi

A.Ş.” at participation rate of 20%.