Page 135 - Annual Report 2022

P. 135

73 Banka Kombëtare Tregtare Annual Report 2022

Banka Kombëtare Tregtare Sh.a.

Notes to the Consolidated Financial Statements for the year ended

31 December 2022 (Amounts in USD, unless otherwise stated)

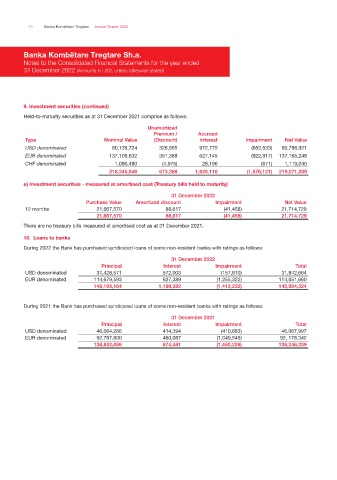

9. Investment securities (continued)

Held-to-maturity securities as at 31 December 2021 comprise as follows:

Unamortized

Premium / Accrued

Type Nominal Value (Discount) interest Impairment Net Value

USD denominated 80,139,724 326,955 972,775 (652,533) 80,786,921

EUR denominated 137,109,632 351,388 627,145 (922,917) 137,165,248

CHF denominated 1,096,490 (4,975) 28,196 (671) 1,119,040

218,345,846 673,368 1,628,116 (1,576,121) 219,071,209

e) Investment securities - measured at amortised cost (Treasury bills held to maturity)

31 December 2022

Purchase Value Amortized discount Impairment Net Value

12 months 21,667,570 88,617 (41,458) 21,714,729

21,667,570 88,617 (41,458) 21,714,729

There are no treasury bills measured at amortised cost as at 31 December 2021.

10. Loans to banks

During 2022 the Bank has purchased syndicated loans of some non-resident banks with ratings as follows:

31 December 2022

Principal Interest Impairment Total

USD denominated 31,428,571 572,003 (157,910) 31,842,664

EUR denominated 114,679,593 627,389 (1,255,322) 114,051,660

146,108,164 1,199,392 (1,413,232) 145,894,324

During 2021 the Bank has purchased syndicated loans of some non-resident banks with ratings as follows:

31 December 2021

Principal Interest Impairment Total

USD denominated 46,064,286 414,394 (410,683) 46,067,997

EUR denominated 92,767,800 460,087 (1,049,545) 92, 178,342

138,832,086 874,481 (1,460,228) 138,246,339